Token

Credit and payment guarantees aligned with sovereign currencyStablecoins excluded from the official policy track

Read More

Stablecoins increasingly replace parts of real-world payment functionsIllicit financial flows continue shifting away from Bitcoin

Read More

Central banks diversify away from the dollar toward euro and gold U.S.

Read More

Stablecoin yields mimic Ponzi dynamics and amplify run risk Ban interest on payment tokens; regulate platforms that bolt on returns Educators and institutions should teach risks and keep payments separate from investments

Read More

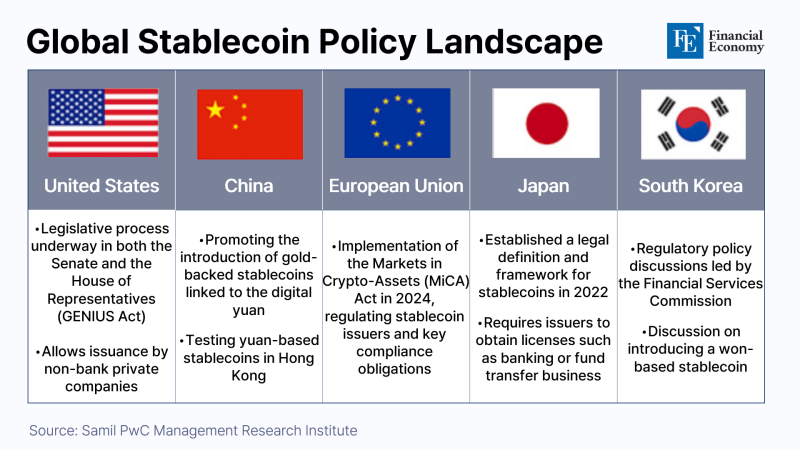

Debate Intensifies Over Issuers of Won-Pegged Stablecoins BOK: “Non-Bank Issuance Involves Greater Risk and Weaker Oversight” Non-Bank Sector: “Bank Monopoly Lacks Logical Justification” As South Korea moves toward legislation governing

Read More

From Hidden Road Acquisition to Ripple Prime LaunchCrypto Industry Shifts Toward Institutional Consolidation

Read More

Europe shouldn’t ban multi-issuer stablecoins; it should backstop them Require joint redemption, a prefunded mutual buffer, and fast resolution to contain failures This builds euro-scale alternatives to dollar coins while reducing systemic risk

Read More

Beijing Strengthens Its Single Digital-Yuan FrameworkShuts Down Private Stablecoin Pathways

Read More

BOK Identifies Seven Major Risks Including Depegging and Coin Runs Issuance by Big Tech Firms Would Undermine the Banking–Commerce Separation Principle “Not About Blocking Innovation — Stability and Trust Must Be Anchored in Bank-Led Management”

Read More

Japan Considering Allowing Bank-Affiliated Firms to Enter the Cryptocurrency Market Since the 2016 revision of the Payment Services Act, Japan has maintained a pro-crypto stance This year’s PSA amendment aims to accelerate deregulation and establish clearer market rules

Read More

Regulatory vacuum stalls institutional adoptionIllegal trading and manipulation cloud the market

Read More

CBDC success depends on token network effects, not cash-back incentives Merchant acceptance and interoperability tip usage Design rails and transparency—not subsidies—win The most critical fact in payments today i

Read More

PayPay and Binance Japan Partner Amid Stablecoin Boom PayPay Eyes Expansion Ahead of IPO Japan Moves Beyond Cash Toward a Cashless Society Photo = PayPay Offcial Website Japan’s cashless payment

Read More

Trump’s tariff threat sparks crypto crash “COVID-scale bombshell” — XRP halves in 30 minutes Bitcoin plunges over 8% in two days The crypto market’s fragile leverage structure has once again hit its limit.

Read More

Domestic transfers are instant; cross-border isn’t Linking FPS enables instant cross-border payments Stablecoins’ edge narrows; universities integrate Over seventy countries already transfer money domestically in sec

Read More

Plans for Large-Scale Capital Raise via Equity SaleUncertainty Over Capital Use and Investment Strategy

Read More

Crypto Influencer Claims Apple Will Buy XRP in Bulk But Apple’s Track Record Shows No Reason to Embrace High-Risk Assets Speculation Also Rises Over Possible Apple–Ripple Partnership Rumors are spreading that Apple plans to purchase the crypt

Read More

Ripple, global custody business expansion Resurrecting medieval bank-style deposit model RLUSD settlement infrastructure rollout Ripple, the issuer of XRP—the world’s third-largest cryptocurrency by market capitalization—is preparing to laun

Read More

Token value comes from network use, not only cash flows Teach Metcalfe-style metrics—active users, adjusted settlement, fees and ETF signals—with transparent filters Update curricula to pair demand-based valuation with risk and regulation

Read More