Financial

State-backed IPOs shift focus from returns to political trust Government backing reshapes how investors price risk Accountable design will decide their long-term success In late 2025, Beijing quietly rewired listing rules so th

Read More

Prolonged Western Sanctions and India’s Exit Weigh on Russian Crude Demand Urals Crude Plunges, Cargoes Pile Up at Sea as China Exports Near Ceiling Cornered Moscow Pursues Economic Engagement With Washington, Including Return to Dollar Settlement

Read More

Moves to divest flagship U.S. assetsRenovation seen as pre-sale value enhancementAftereffects of Anbang’s expansion phase come into focus Waldorf Astoria New York Hotel/Photo=Waldorf Towers

Read More

Healthcare and Social Assistance Accounting for 95% of Job Gains Contraction in White-Collar Industries Including Finance Formation of a Low-Employment, High-Productivity Economic Order U.S.

Read More

Proposal centers on an “energy + currency + policy” economic allianceWar costs, sanctions pressure, and frozen assets add complexity

Read More

Trade resilience has real economic value in a volatile world Protection can act as temporary insurance, but productivity is the stronger long-term hedge Policy must price trade risk honestly and invest in domestic capacity Glob

Read More

A Chinese invasion of Taiwan could slash global GDP by 10%, with South Korea and Japan Facing Direct Impact Semiconductor Supply Chain Collapse Threatens Advanced Industries and Financial Markets Russia-Ukraine War Imposes Massive Economic Losses Amid Protracted Conflict

Read More

Kering Grapples With Gucci Weakness, Moves to Divest Assets and Restructure Operations Major Luxury Houses Post Parallel Earnings Declines, Global Industry Growth Momentum Stalls Unprecedented Demand Retrenchment Driven by Gen MZ Pullback and China Property Slump

Read More

Setback to Currency-Based Expansion of ‘Coin Hub’ StrategyOpen Listings in Name, But a Gap Between Policy and Market Reality

Read More

High public debt is weakening the power of the zero lower bound in Europe When fiscal credibility erodes, lower interest rates no longer guarantee stronger growth or stable inflation Europe must rebuild fiscal space and institutional trust if monetary policy is to work again

Read More

Shift in the beneficiary of productivity gainsLabor share of income declines, warning signs in employment data

Read More

Cooling inflation without signs of a rebound in consumption or employment AI-driven shifts in labor structure and tariff-related uncertainty accumulate Eroding demand for Treasuries and weakening confidence in the dollar further constrain rate cuts

Read More

China’s domestic deflation is no longer contained; it now reshapes global prices, profits, and financial risk Industrial subsidies extend price pressure, turning a trade shock into a systemic financial spillover Global policy must adapt quickly to manage a deflationary force emanating from the world’s manufacturing center

Read More

S&P Slashes China’s New-Home Sales Forecast, Warning of Prolonged Downturn Rapid Expansion of Advanced Industries Falls Short of Replacing Growth Engine “Growth Could Falter at Any Moment” China’s Economy Balances on a Knife’s Edge

Read More

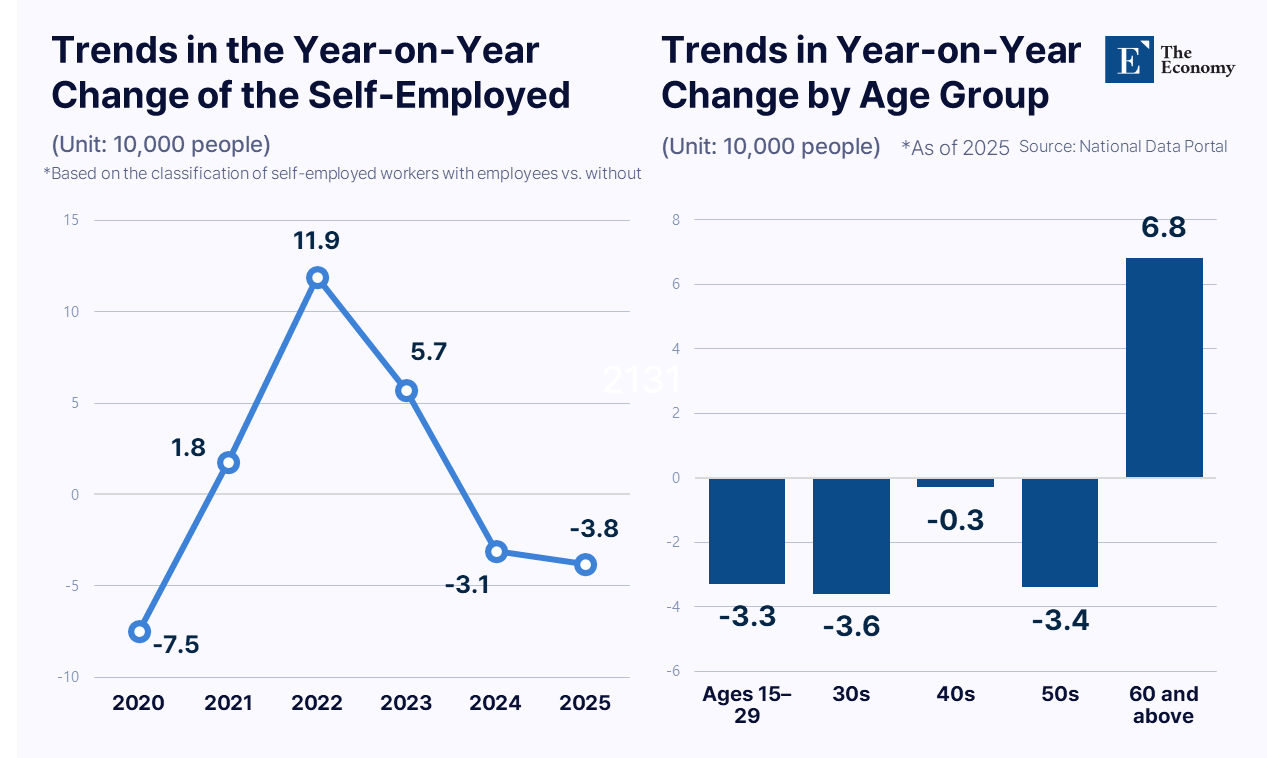

Business closures hit a four-year high as young entrepreneurs disappear Shrinking corporate activity erodes household purchasing power South Korea’s domestic market stands at the edge of chronic contraction The self-employed sector,

Read More

Yen Weakness and Government Bond Selling Pressure Expand SimultaneouslyMarkets on Alert Over Possible Unwinding of Yen Carry Trades

Read More

Interest costs on federal debt have already surpassed current defense spending, Federal interest outlays projected to reach $1.8 trillion by 2035, Explosive AI-driven growth touted as the last bulwark against sovereign default As U.S.

Read More