AI-Resilient Sectors Underpin U.S. January Employment as “Jobless Growth” Takes Hold Across Broader Economy

Input

Modified

Healthcare and Social Assistance Accounting for 95% of Job Gains Contraction in White-Collar Industries Including Finance Formation of a Low-Employment, High-Productivity Economic Order

The U.S. labor market is charting a markedly different course from past cycles. While rapid advances in artificial intelligence and automation have entrenched hiring slowdowns in technology and manufacturing, job creation has become increasingly concentrated in healthcare and social assistance—sectors largely insulated from AI substitution—underscoring a qualitative shift in employment dynamics. As productivity surges alongside hiring restraint, the labor market appears to be gravitating toward a new equilibrium defined by jobless growth.

January Job Gains Concentrated in AI-Resistant Sectors

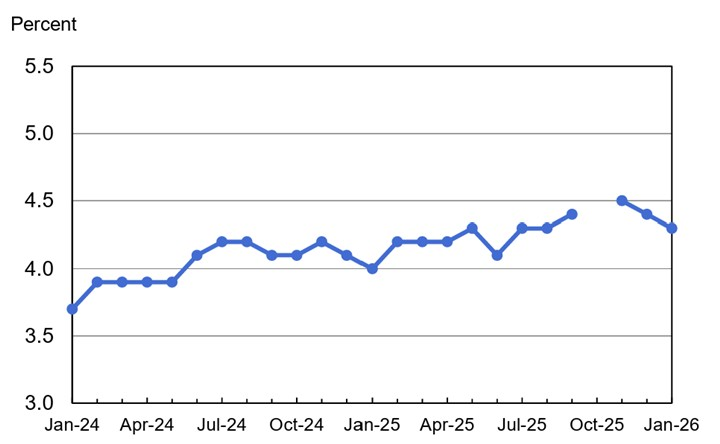

According to the Bureau of Labor Statistics under the U.S. Department of Labor, total nonfarm payrolls increased by 130,000 in January from the previous month. The figure represents a sharp acceleration from the revised December gain of 48,000 and significantly exceeded market expectations. Dow Jones had projected 55,000 new jobs, while Bloomberg forecast 69,000. The unemployment rate declined to 4.3% from 4.4%, outperforming expectations of 4.4%.

Although January’s headline data signaled clear month-on-month improvement, the underlying composition tempers optimism. Healthcare and social assistance drove the bulk of gains. Employment in the sector rose by 123,500, accounting for more than 95% of total job growth. Yet hiring in this segment tends to expand in tandem with demographic aging rather than broader cyclical conditions.

The U.S. healthcare industry has sustained long-term employment expansion amid rising demand linked to an aging population. The sector is also heavily reliant on immigrant labor. According to U.S. Census data compiled by IPUMS, foreign-born individuals accounted for less than 15% of the total U.S. population in 2024 but represented 39% of home health aides, 28% of physicians, and 24% of dentists. Construction, which also posted job gains in January, shows a similarly high dependence on immigrant workers. Roughly 25% of construction workers are foreign-born, with the proportion reaching nearly half in certain occupations.

By contrast, employment declined in finance, IT, and telecommunications. The high-wage financial sector shed 22,000 jobs, while IT and media lost 12,000. Telecommunications alone accounted for a reduction of 15,000 positions, reflecting the continued impact of large-scale restructuring that began last year. Analysts attribute the contraction to rapid advances in AI and automation. Manufacturing payrolls have also trended downward for several consecutive months as elevated interest rates and increased capital investment in automation dampen labor demand in traditional industries.

Layoff Shock Intensifies with 100,000 Cuts in a Single Month

AI-driven disruption has already reshaped the U.S. labor market landscape. Early projections suggested that blue-collar roles would bear the brunt of automation. However, the advent of generative AI, exemplified by ChatGPT, has precipitated sweeping reductions in white-collar employment. More than 100,000 layoffs were announced last month alone, led by technology firms—an increase of 118% from a year earlier. Global technology giants including Amazon, Microsoft, and Google have pursued workforce reductions despite delivering record earnings.

According to The New York Times, Amazon announced plans on the 28th of last month to eliminate 16,000 corporate positions. The move followed 14,000 layoffs in October and brought the company’s total announced cuts over the past three months to 30,000. The reductions are widely interpreted as both a response to AI-driven labor efficiencies and a strategic effort to secure capital for intensifying AI competition.

Automation adoption has also prompted major logistics operator UPS to implement up to 30,000 additional layoffs and facility closures, following cuts last year. The latest reductions target parcel processing and delivery roles. Previously, UPS eliminated 48,000 positions—14,000 managerial and 34,000 operational—and shuttered 93 facilities. Salesforce, a leading customer relationship management provider, has sharply scaled back customer support functions, with AI now handling up to 50% of corporate workloads. As workforce restructuring linked to AI becomes tangible, warnings from the International Monetary Fund that AI could affect 60% of jobs in advanced economies within several years no longer appear overstated.

Hiring volumes have also contracted sharply. New job postings totaled 5,306 in January, the lowest level since January 2009. Signs of labor market deterioration had already emerged last year. According to the Job Openings and Labor Turnover Survey, job vacancies fell to 6.54 million in December, down 970,000 from a year earlier and 386,000 from the prior month, marking the lowest reading since September 2020. The decline was particularly pronounced in coding occupations. Research from Stanford University’s Digital Economy Lab indicates that employment for software developers fell nearly 20% in 2024 compared with late 2022. A joint study by Harvard University and King’s College London found that companies adopting AI, particularly in the technology sector, have curtailed junior-level hiring.

Productivity Maximization Through AI

These developments are fundamentally reshaping labor market mechanics. The Wall Street Journal reports a surge in so-called reverse recruiting firms, which charge job seekers to secure employment opportunities. Traditionally, companies paid recruitment agencies to fill vacancies; the reversal underscores a cooling labor market and the rapid contraction of white-collar roles amid AI diffusion.

Economists argue that AI-driven productivity gains could enable robust growth with subdued employment expansion. In a recent report, Goldman Sachs noted that jobless growth is steering the U.S. labor market onto a new trajectory. The confluence of AI proliferation, demographic aging, and restrained immigration has fostered a new normal characterized by stagnant employment and rising productivity.

Data from the Department of Labor show that nonfarm business productivity surged at an annualized rate of 4.9% in the third quarter of last year, the highest since the third quarter of 2023. Second-quarter productivity was revised upward to 4.1% from a prior estimate of 3.3%. Productivity growth exceeding 4% for two consecutive quarters was last recorded in the immediate aftermath of the COVID-19 shock in 2020, when second- and third-quarter gains reached 20.9% and 6.4%, respectively. Over the six-month period from April to September last year, however, average monthly nonfarm job gains amounted to just 53,000. Even so, the U.S. economy expanded at annualized rates of 3.8% and 4.3% in the second and third quarters.

Federal Reserve Chair Jerome Powell stated that productivity appears to have risen in a sustained manner over several years, adding that he had not anticipated a period in which productivity would increase by 2% annually for five to six years. Citing AI as one of the contributing factors, Powell noted that if productivity advances by 2% each year, the economy can sustain higher growth without commensurate job creation. Some analysts caution that labor markets may continue to experience acute dislocation until the productivity contribution of AI tools reaches saturation. A persistent divergence between the pace of job displacement driven by technology and the rate of new job creation could define the near-term outlook.