[AI Bubble] Approaching the $1 Trillion Bond Era, as the ‘War Chest’ for AI Infrastructure Intensifies

Input

Modified

Surging capital investment, including the emergence of 100-year bonds

Debate over hidden liabilities and funding sources gains momentum

Long-term repayment burdens signal pressure on future cash flows

Global issuance of technology- and artificial intelligence (AI)-related bonds is projected to reach record levels this year, ushering Big Tech’s AI infrastructure race into a new phase. Alphabet, in particular, has accelerated its long-term investment strategy through capital markets, raising substantial funds in a short span since the second half of last year and moving forward with plans to issue 100-year bonds. Meanwhile, markets have begun to scrutinize off-balance-sheet liabilities and deteriorating free cash flow indicators across major tech firms, fueling debate over financial sustainability. As competition over AI infrastructure intensifies, the timing of investment payback and disparities in financial resilience are emerging as pivotal variables.

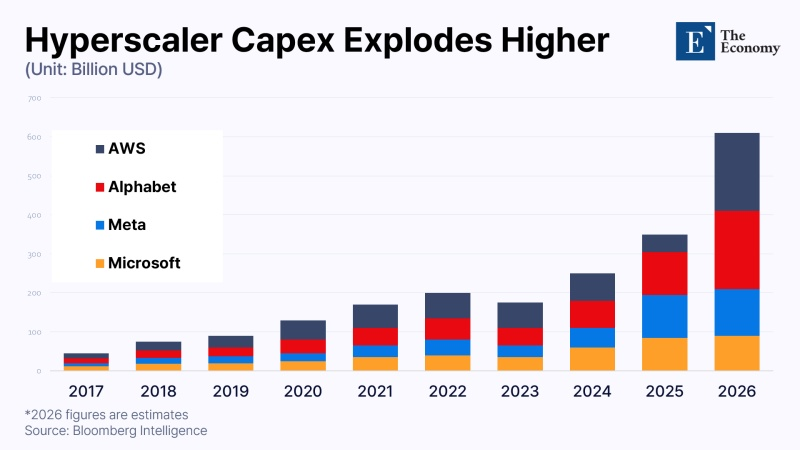

Four Big Tech Firms Expected to Exceed $630 Billion in CAPEX

According to Bloomberg on the 12th (local time), global issuance of technology- and AI-related bonds is forecast to reach $990 billion this year, a 28 percent increase from $710 billion last year. Bloomberg projects that most of this capital will be directed toward AI infrastructure development. Morgan Stanley similarly estimated in a report the same day that global funding demand for AI infrastructure could total $1.5 trillion this year. The capital-intensive race to secure data centers, semiconductors, and power infrastructure is drawing heightened market attention.

Bloomberg Intelligence estimates that capital expenditures (CAPEX) by Amazon, Alphabet, Meta, and Microsoft are likely to exceed $630 billion this year. Amazon alone has pledged $200 billion toward AI development and infrastructure, significantly above prior market expectations of $150 billion. Amazon Web Services (AWS) generated $142 billion in revenue last year, up 24 percent year over year. However, concerns that such aggressive investment could strain the company’s financial position contributed to an 11.5 percent decline in Amazon’s share price in after-hours trading on the 6th.

Financing strategies have also evolved. Alphabet recently assembled an underwriting syndicate to issue 100-year bonds denominated in British pounds, alongside seven tranches of U.S. dollar bonds with varying maturities. Its 40-year corporate bonds have reportedly been priced at a spread of 0.95 percentage points over comparable U.S. Treasuries. In November last year, Alphabet raised $17.5 billion in the U.S. bond market and $6.5 billion in Europe; the 50-year bond issued at that time was the longest maturity offered by a U.S. technology company during the year.

Investment banking analysts suggest that if ultra-long-dated issuance spreads across Big Tech, total U.S. corporate bond issuance could reach $2.46 trillion this year. Morgan Stanley noted that so-called hyperscalers may raise up to $400 billion in additional debt, marking a shift from funding capital expenditures through operating cash flow to reliance on bond markets. In this view, the AI infrastructure race is reshaping not only industrial competition but also corporate financing models.

Concerns Over Spillover Effects on the Financial System

As funding volumes for AI infrastructure swell, scrutiny over hidden liabilities and financing structures has intensified. While public narratives emphasize expansion and growth, analysts argue that substantial borrowings not immediately reflected on balance sheets have accumulated. The Financial Times reported that four companies—Oracle, Meta, xAI, and CoreWeave—raised a combined $118.6 billion in AI-related funding through special purpose vehicles (SPVs) last year, structures that do not directly register as liabilities on parent company financial statements.

Oracle is estimated to have raised $66 billion via SPVs that own data centers in Texas, Wisconsin, and New Mexico, with Oracle leasing the facilities. Meta secured $30 billion through an SPV named Bene Investor, while xAI raised $20 billion through a separate SPV. CoreWeave’s SPV debt totaled $2.6 billion. Major Wall Street institutions—including PIMCO, BlackRock, Apollo, Blue Owl, and JPMorgan—provided the capital. In the event of default, creditors can typically claim only the physical assets, such as land and equipment, without direct recourse to the parent company.

The scale of projected investment has further fueled skepticism. Goldman Sachs estimates that global Big Tech will deploy $1.15 trillion between 2025 and 2027, with roughly 60 percent concentrated this year. Alphabet has outlined plans to invest $185 billion in capital expenditures this year, while Oracle has indicated $42 billion. Goldman Sachs observed that although Oracle’s investment level appears relatively modest, its aggressive reliance on bond issuance suggests capital expenditures may outpace free cash flow generation.

These developments have prompted warnings about systemic risk. The private credit market, a key source of SPV funding, has expanded rapidly to an estimated $1.7 trillion annually, yet remains vulnerable to asset price volatility, liquidity constraints, and borrower concentration. The Financial Times cautioned that should highly leveraged AI firms encounter financial distress, their debt structures could transmit stress to broader financial markets in unpredictable ways. The “AI bubble” narrative that gained traction in the second half of last year may thus be evolving from concerns about valuation excess into a potential new axis of credit risk.

Criticism of “Excessive CAPEX Relative to Cash Flow”

Within the industry, competitive overinvestment and repayment burdens are increasingly viewed as pressing concerns. Bloomberg likened the scale of Big Tech’s infrastructure buildout to historical milestones such as the expansion of the U.S. railroad network in the 19th century, New Deal-era public works, and post-World War II highway construction. The imperative to secure data center and computational capacity reflects fears that failure to do so could erode market dominance. In this environment, investment size has become both a strategic lever and a defensive line.

Escalating competition is reshaping corporate balance sheets. Meta’s real estate and equipment assets at the end of last year were five times higher than in 2019. Asset composition has shifted from software and talent toward hardware, power infrastructure, and semiconductors, increasing fixed-cost burdens. Critics argue that concentrated spending by a handful of firms could distort broader U.S. economic indicators. Infrastructure expansion may exacerbate power supply imbalances, drive electricity costs higher, and intensify resource conflicts with local communities.

Cash flow metrics underscore mounting strain. According to investment research outlet GuruFocus, Meta’s free cash flow (FCF) per share declined 13.3 percent year over year over the past 12 months, while Amazon’s fell 75.7 percent. FCF, defined as operating cash flow minus capital expenditures, is often the first indicator to weaken during aggressive investment cycles. GuruFocus noted that even profitable firms can face liquidity pressures if cash flow deteriorates, signaling potential red flags amid AI bubble concerns.

The gap between market expectations and tangible performance remains another key variable. Tomasz Tunguz, senior researcher at Theory Ventures, observed that Nvidia surpassed a $1 trillion market capitalization in 2023 and exceeded $5 trillion by October last year. He suggested parallels between the current AI investment boom and the dot-com bubble. In an interconnected demand-supply cycle among major AI firms, disruption in one segment could reverberate across the value chain. In such a scenario, differences in cash generation capacity and debt repayment strength may become increasingly apparent. In a phase of heightened competition, disparities in financial resilience and investment recovery speed could ultimately determine corporate outcomes.

Comment