When Trust Outbids Return: How state-backed IPOs Rewire Investor Logic

Input

Modified

State-backed IPOs shift focus from returns to political trust Government backing reshapes how investors price risk Accountable design will decide their long-term success

In late 2025, Beijing quietly rewired listing rules so that companies building reusable rockets can list without meeting the usual profit thresholds. That policy change did not flow from a market demand signal. It flowed from a political judgment: certain firms matter because they serve a national industrial goal, not because their near-term returns look tidy on Excel. That single move encapsulates a broader truth about modern Chinese capital markets: investors there often buy the state’s promise rather than a firm’s cash flow. The result is a marketplace where balance sheets and burn rates matter less than political proximity, and where crowdfunding and public offerings are retooled as instruments of state strategy. This piece reframes the question policymakers typically ask—“how do we improve liquidity?”—into a sharper one: “how does the political valuation of firms change investor incentives and the shape of innovation?” The answer has direct consequences for educators training future managers, administrators allocating capital, and regulators designing disclosure and listing rules.

State-backed IPOs and the new rocket economy

China’s decision to ease IPO rules for reusable-rocket firms is the clearest recent marker that state-led priorities now shape issuance criteria. Regulators permitted qualifying firms to bypass conventional revenue or profitability thresholds if they met technological milestones aligned with national goals. The immediate effect is pragmatic: faster access to capital for firms that otherwise find it difficult to show tidy profits while they experiment with novel, high-cost hardware. But the larger effect is normative. It signals to retail and institutional investors alike that state endorsement substitutes for traditional financial proof. According to research by Tan Li, Jar-Der Luo, and Enying Zheng, investors may not always view political approval as reducing risk; findings show that government venture capital backing in China is associated with lower IPO valuations.

This matters because capital allocation follows incentives. When the entry rulebook prioritizes policy consistency over short-term cash flow, three predictable dynamics emerge. According to Yicai News, government subsidies in China tend to boost short-term excess returns for IPO firms, and this effect is even more pronounced for state-owned enterprises, which may help them secure cheaper capital and support for innovative efforts even when market returns are uncertain. Third, a market built on political valuation can mask true firm-level performance, slowing the discovery of which technologies are viable on commercial terms. These are not abstract risks; they change what managers prioritize, which curricula produce the most useful graduates, and how university incubators mentor start-ups that expect state-linked capital rather than private-market discipline.

Trust, not taste: retail behavior and the Chinese market fabric

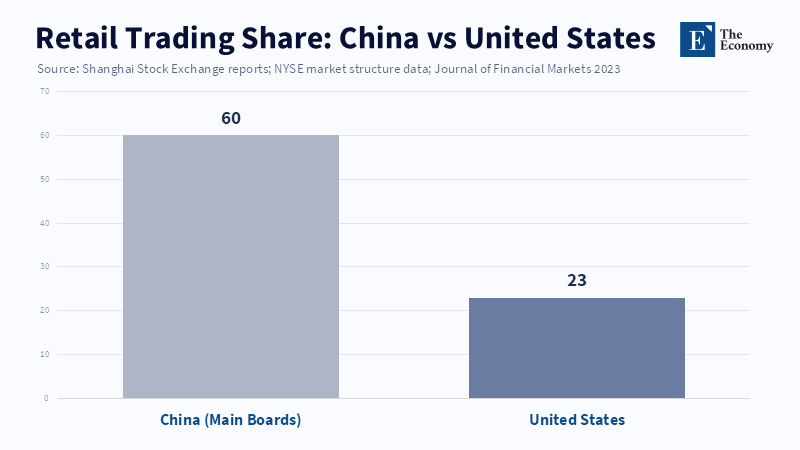

The behavioral substrate of those dynamics is the composition and psychology of China’s investor base. China’s equity markets have a much larger share of retail trading than those in mature Western markets. Multiple market studies and exchange disclosures indicate that retail investors account for the majority of daily trading volume on China’s main boards—a share far above typical U.S. levels. Retail dominance amplifies momentum and narrative-based flows. Individual investors, quick to buy into a national mission narrative and slow to price in complex downside scenarios, can generate outsized demand for IPOs that fit a patriotic or state-endorsed frame. That demand creates the conditions under which an IPO can succeed even when traditional valuation metrics might be unconvincing.

The implications reach beyond headline volatility. Retail-led demand creates two policy tensions. According to recent research, rising geopolitical risk in China can lead ordinary savers to invest in firms with greater uncertainty about returns, exposing their wealth to political risks rather than standard market fluctuations. The same study suggests that similar dynamics around IPOs might encourage listed companies, supported by a sympathetic retail investor base, to place less focus on corporate governance and independent oversight. For educators, this implies a need to teach students to read political endorsements as a financial variable—not simply as a geopolitical news item. Administrators in universities and accelerators must also design mentorship that helps founders balance state engagement with strong commercial validation. Regulators, meanwhile, face the thorny job of protecting retail savers without strangling the policy objectives that motivated such relaxed listing criteria.

Innovation trade-offs: evidence from IPO intervention studies

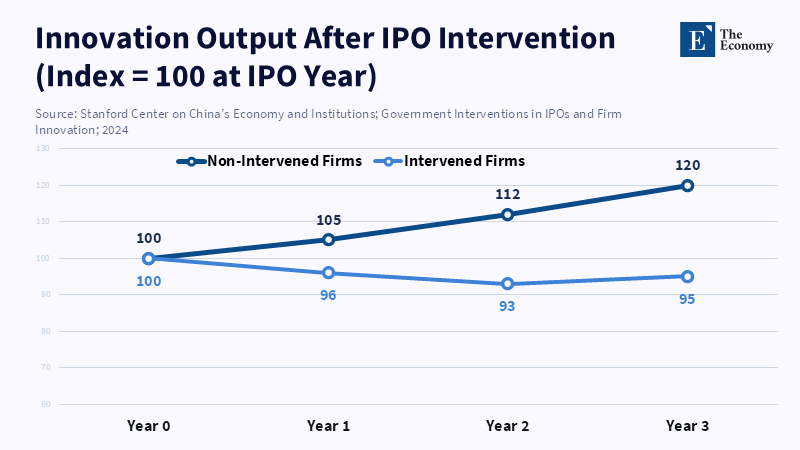

We must confront the evidence about what happens when governments intervene in IPO processes. Recent empirical work that tracks Chinese firms affected by listing suspensions or administrative interventions finds measurable declines in innovation output in the years that follow. Compared with unaffected peers, firms subject to IPO disruptions filed fewer patent applications and received fewer citations, and it took several years for innovation activity to recover. The pattern points to a greater coordination problem: when political calculus, rather than pure market selection, determines which firms receive capital or breathing room, innovation incentives can shift in ways that reduce exploratory investment inside firms. That is not to say that state support always harms innovation; rather, when support substitutes for market discipline without compensating for governance mechanisms, firms may lose the incentive to translate R&D into efficient, economically viable technologies.

Translating those findings into practice requires nuance. A rocket firm that needs a decade of iterative tests may legitimately require patient capital that only a hybrid public–private financing model can deliver. The policy error is to imagine that state-backed listing alone creates a self-correcting ecosystem. Without transparent milestone-based governance and staged funding tied to independent verification, patient capital risks become unconditional capital. That reduces firms’ incentives to optimize for cost, manufacturability, or modularity — attributes that matter for wide adoption. For educators, the lesson is clear: train engineers and managers to embed external verification and stage-gated metrics into projects that will rely on state-linked financing. For regulators, the corrective is equally clear: couple preferential listing rules with stronger post-listing disclosure and milestone audits to preserve accountability.

Rethinking policy design for accountable state-backed IPOs

If the policy aim is to accelerate strategic industries while protecting investors, then listing rules must be redesigned to reflect both political aims and market signals. Rather than a binary relaxation of profit rules, regulators can adopt a conditional model: preferential pathways tied to independent technical audits, rolling financing tranches, and mandatory clawback or escrow mechanisms for proceeds tied to milestones. This mixed approach keeps capital flowing for long-horizon projects while preserving some of the market’s information discipline. It also respects retail investors by making explicit the non-commercial risks attached to particular issues. We should not ask whether state-backed IPOs are inherently good or bad. We must ask how to make them transparently conditional, so political value does not become a veil for poor corporate accountability. The rocket policy change provides a pilot case to test these instrument designs.

Hands-on implementation matters. Exchanges can require special prospectus sections for state-backed IPOs that quantify the degree and form of state support, enumerate technological milestones, and specify how proceeds will be used across tranches. Listing regulations may require the appointment of independent technical trustees in industries with long R&D cycles. For university programs and incubators, syllabi should comprise modules that teach founders how to structure milestone-linked financing and how to present evidence to independent auditors. Administrators at public research universities should also reevaluate technology-transfer incentives, ensuring that commercialization pathways do not rely on regulatory favoritism but on demonstrable product-market fit and manufacturability. These steps shrink the gap between political intent and commercial reality.

The rocket-policy shift is a test, not a verdict. It shows the state can mobilize markets to pursue long-horizon technological capacity. It also exposes a fragile truth: when political valuation substitutes for expected-return computation, markets shift from disciplinarian to enabler. That dual role requires rigorous design. We must preserve capital markets' capacity to fund ambitious engineering while keeping investors informed and accountable. Instructors must teach future managers the hybrid language of policy and finance. Regulators must install conditionality, independent verification, and staged financing to make state-backed IPOs instruments of strategic success rather than accelerants of opaque risk. If we accept that public aims sometimes require public patience, then we must also insist that patience be earned and audited. Only then will state-backed IPOs be a lever for durable innovation, not a momentary subsidy dressed up as a market triumph.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of The Economy or its affiliates.

References

East Asia Forum (2026) ‘Beijing’s stock exchange values policy over liquidity’, East Asia Forum, 14 February.

Reuters (2025) ‘China eases IPO rules for firms developing reusable rockets’, Reuters, 26 December.

Reuters (2025) ‘China’s LandSpace targets $1 billion IPO in reusable rocket tech push’, Reuters, 31 December.

Stanford Center on China’s Economy and Institutions (SCCEI) (2024) ‘Government interventions in initial public offerings and firm innovation in China’, SCCEI China Briefs, Stanford University.

ScienceDirect (2023) ‘Heterogeneous investors in China: retail dominance and market structure’, Journal of Financial Markets.