Small Business Crisis Deepens as Corporate Slowdown Fuels Looming Collapse of Domestic Demand

Input

Modified

Business closures hit a four-year high as young entrepreneurs disappear Shrinking corporate activity erodes household purchasing power South Korea’s domestic market stands at the edge of chronic contraction

The self-employed sector, long a critical pillar of South Korea’s economic fundamentals, is unraveling at an accelerating pace. Rising closures across neighborhood commercial districts signal deepening fractures within the broader economy. The collapse of small business owners—once a buffer linking employment and consumption—is directly weakening domestic demand and undermining economic resilience. A causal feedback loop is taking hold, in which deteriorating corporate profitability suppresses household income, triggers consumption retrenchment, and further constrains the prospects for a domestic recovery.

Self-Employed Sector Falters, Shrinking by Tens of Thousands for a Second Consecutive Year

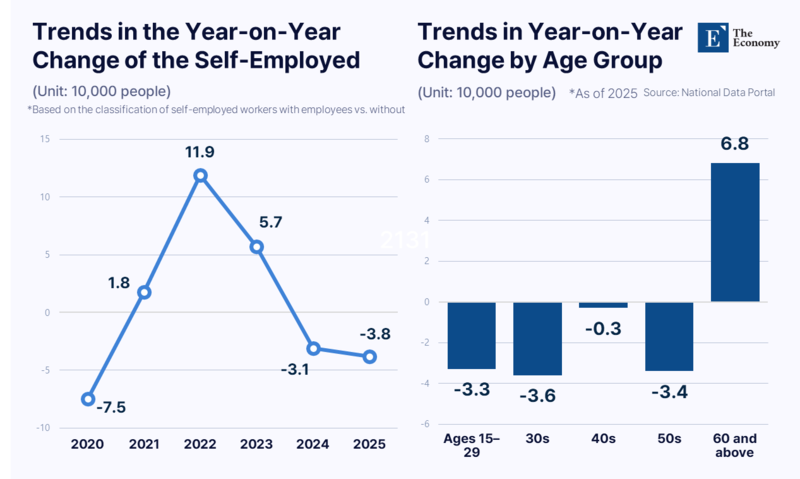

According to the National Data Agency’s statistical portal, the number of self-employed workers fell by 38,000 year-on-year to 5.62 million last year, marking the steepest decline in five years since the onset of the COVID-19 pandemic in 2020. The contraction followed a decline of 32,000 in 2024, extending the downtrend for a second consecutive year. After plunging by 75,000 in 2020, the self-employed population rebounded amid eased distancing measures and the shift to endemic conditions, rising by 18,000 in 2021, 119,000 in 2022, and 57,000 in 2023, before reversing course again in 2024.

The downturn has been especially severe among younger cohorts. Microdata from the employment trend survey show that the number of self-employed individuals aged 15 to 29 fell by 33,000 year-on-year to 154,000. Following declines of 22,000 in 2023 and 3,000 in 2024, the segment has now shrunk for three consecutive years. Self-employed workers in their 30s also dropped by 36,000 to 636,000, extending a multi-year slide marked by declines of 1,000 and 35,000 in the previous two years. The agency attributed the contraction among those aged 15 to 29 mainly to accommodation and food services as well as transport and warehousing sectors that include delivery riders, while the decline among those in their 30s was concentrated in transport, warehousing, and wholesale and retail trade. Tax data further corroborate the trend, showing that the number of young entrepreneurs fell from 396,000 in 2021 to roughly 350,000 in 2024.

Although the government issued consumption vouchers last year, briefly raising expectations of a domestic rebound, the measures proved insufficient to reverse the sector’s entrenched weakness. Accumulated high interest rates, rising labor costs, and sluggish demand continued to drive closures. Data from the Ministry of the Interior and Safety’s local licensing portal show that closures have exceeded new business registrations for two consecutive years. In 2024, 102,536 new licenses were issued, while closures totaled 109,949, exceeding openings by 7,413. The previous year saw 97,296 new licenses against 114,159 closures, leaving a gap of 16,863. Given that closures historically hovered at 80–90% of new licenses, the past two years starkly illustrate the contraction of the self-employment ecosystem.

Triple Deterioration in Domestic Demand, Exports, and Investment Locks in Low-Growth Trajectory

South Korea’s economy is now facing unprecedented strain as interest rates, inflation, and debt worsen simultaneously, with self-employed workers bearing the brunt of the pressure. Despite forming a core pillar of employment and consumption, they are typically the first to be hit as economic conditions tighten. With consumption shrinking and commerce shifting toward online platforms, brick-and-mortar districts are deteriorating first. Persistent rent and platform fee burdens, coupled with dwindling foot traffic, are accelerating closures and pushing regional economies toward systemic distress.

Freelancers and sole proprietors, once seen as beneficiaries of labor flexibility, now face direct displacement risks from artificial intelligence automation while remaining largely outside robust social safety nets. Income instability is suppressing consumption, feeding back into declining small business revenues and ultimately slowing production and investment among small and mid-sized enterprises. While central and local governments have rolled out financial support and livelihood measures, these interventions have largely remained liquidity-focused and have failed to translate into sustained demand creation.

The roots of weak domestic demand lie in the erosion of corporate value creation, the primary source of household income. According to a business sentiment survey of the top 600 companies by revenue conducted by the Korea Enterprises Federation, the Business Survey Index stood at 95.4 in January, signaling that pessimistic outlooks outweigh optimism. The index has remained below the neutral threshold of 100 for 47 consecutive months since February 2022. By sector, domestic demand, exports, and investment have all been deteriorating simultaneously for 19 straight months.

Limits of Revenue Generation per Hour Worked

With domestic weakness and external uncertainties such as high tariffs intensifying, low growth has become a foregone conclusion. Major forecasting institutions project South Korea’s economic growth this year at 1.8–2.0%. While this marks a rebound from last year’s 1.0%, analysts broadly agree that the figure reflects a statistical illusion driven by semiconductor export gains and effectively amounts to near-zero growth. The pace still trails that of key competitors including the United States, Japan, and Taiwan, while per capita GDP has fallen behind Taiwan for the first time in 22 years. The economy remains trapped in a long-standing “$30,000 income ceiling,” equivalent to roughly $32,000, reinforcing chronic stagnation.

At the core of South Korea’s economic constraints lies weak productivity. According to the OECD, the country’s hourly labor productivity stood at $57.5 in 2024, ranking 31st among 38 member states. Although the ranking improved by two places from the previous year, it merely returned to the 2021 level and has remained in the bottom tier since slipping out of the top 20 in 2018.

While productivity lags behind advanced economies, unit labor costs reached $118.7, ranking eighth among OECD members. Workers generate less output per hour than their counterparts in rival economies, yet labor costs remain elevated. In 2024, average annual wages stood at $50,900, ranking 19th among OECD members and amounting to 90% of the OECD average. According to the Korea Employers Federation, total compensation for manufacturing workers, measured on a purchasing power parity basis, exceeded that of Japan and Taiwan by roughly 25%. Since 2011, manufacturing wages in South Korea have surged by 83%, far outpacing Japan’s 35%, underscoring the economy’s entrenched high-cost, low-efficiency structure.

Boosting productivity ultimately requires raising revenue generated per hour worked, a challenge that cannot be resolved through individual or corporate effort alone. It demands the presence of competitive growth engines at the industrial level. Yet South Korea currently lacks new flagship industries, even as the profit-generating capacity of its existing sectors weakens. In a structure where firms struggle to secure adequate profits, expectations for a meaningful revival in domestic demand remain fundamentally constrained.