IMF: "UK to See Fastest Tax Hike Among G7 Nations" — Tax Hike Pressure Spreads Across Europe

Input

Modified

IMF Projects 2.3% Increase in UK Tax Ratio by 2029 Labour: “Tax Hikes Unavoidable to Tackle Fiscal Deficit” France Weighs 2% Wealth Tax on Ultra-Rich Individuals

Amid growing fiscal strain across Europe triggered by U.S. protectionism and tariff wars, the International Monetary Fund (IMF) has projected that the United Kingdom will experience the fastest tax hike among G7 economies. The move, however, has sparked fierce political backlash. The Labour government’s indication that it may raise taxes to restore fiscal discipline has drawn criticism not only from the Conservative and Reform parties but also from within Labour itself. Meanwhile, in France, a renewed debate over wealth taxation targeting the ultra-rich is reigniting broader discussions on fiscal redistribution across Europe.

Tax Revenue to Rise by $83 Billion — Steepest in the G7

On October 16 (local time), the IMF stated that “the United Kingdom is expected to record the fastest tax increase among the G7 countries,” adding that “under Chancellor Rachel Reeves’ fiscal policy, tax revenues as a share of GDP will rise from 38.3% in 2024 to 40.6% by 2029 — an increase of 2.3 percentage points.” In absolute terms, this translates to an estimated $83 billion in additional tax income — the largest rise among advanced economies.

The Telegraph interpreted the IMF’s forecast as “a sign reinforcing the likelihood of higher tax burdens under the Labour government ahead of next month’s budget announcement.” In an interview with Sky News the same day, Chancellor Reeves acknowledged for the first time that “tax increases are under consideration for the November budget.” Since taking office last year, Reeves has maintained that expanding fiscal revenues is unavoidable to offset the massive budget deficit inherited from the previous Conservative administration.

Her remarks immediately triggered political pushback. Conservative MP Mel Stride argued that “Labour’s mismanagement of the economy is suppressing growth while driving up the tax burden faster than in any other developed nation.” Reform Party deputy leader Richard Tice similarly warned that “higher taxes will drive wealth and innovation out of the UK.” Even within Labour, left-wing figures such as Deputy Leader Angela Rayner have voiced discontent over the government’s simultaneous push for welfare cuts and tax hikes.

Trump’s Protectionism Deepening Fiscal Strain

Adding to the domestic challenge is President Donald Trump’s protectionist trade policy, which has exacerbated fiscal pressures worldwide. As of April, the UK’s national debt stood at approximately $3.4 trillion — nearly 100% of GDP. Stefano Passariello, Chief Investment Officer at Invesco, warned that “President Trump’s trade policies pose a serious threat to global growth, particularly for countries already burdened with high debt levels,” adding that “the UK remains extremely vulnerable to such external shocks.”

Paul Dales, an economist at Capital Economics, noted that “Washington’s renewed protectionism risks disrupting global supply chains and intensifying inflation,” cautioning that “higher consumer prices in the UK will erode real household income and weigh on economic growth.” He added that “with the government already under heavy fiscal strain due to energy price surges and the cost-of-living crisis, a global downturn would only further compound Britain’s debt burden.”

Some analysts have even drawn parallels between the UK’s current situation and Greece’s debt crisis of the 2010s. While Britain’s fiscal fundamentals differ, they warn that its high debt levels and susceptibility to external shocks represent clear vulnerabilities. Moreover, in the wake of Brexit, the absence of a fully stabilized trade framework with the European Union leaves the UK exposed to additional risk from rising global protectionism.

Arnault: “Zucman Tax Is Economic Sabotage”

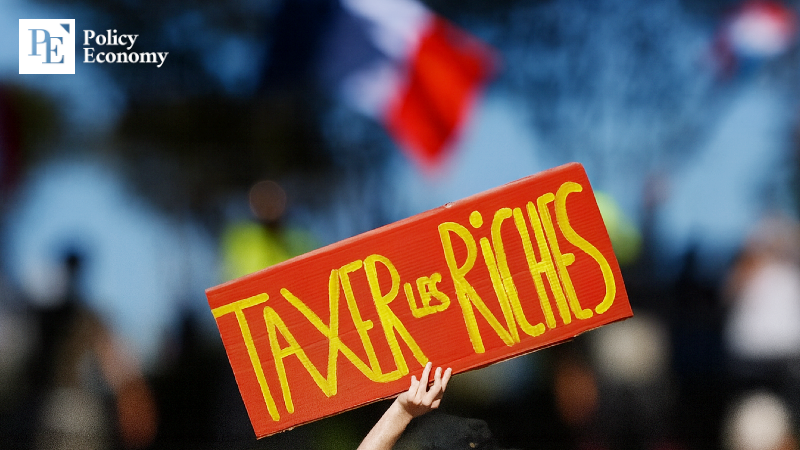

The tax debate is far from confined to Britain. France, grappling with a debt-to-GDP ratio of 113.9%, is also mired in controversy over a proposed wealth tax targeting the ultra-rich. At the center of the debate is the so-called “Zucman Tax,” proposed by UC Berkeley economist Gabriel Zucman, which would impose a minimum 2% annual levy on individuals with net assets exceeding $108 million. Under the proposal, if a taxpayer’s total annual payments fall short of 2% of their net worth, an additional charge would be imposed to meet the threshold.

Only around 1,800 households — a mere 0.005% of France’s 34 million — would be subject to the tax. Zucman estimates it could generate roughly $22 billion in additional annual revenue, offering some relief as France faces the need to cut $48 billion from next year’s budget.

Public sentiment is overwhelmingly in favor. A recent poll found that 86% of French citizens support the tax, including 92% of centrist Renaissance Party voters and 89% of conservatives — an almost unprecedented consensus across France’s traditionally polarized political spectrum.

The ultra-wealthy, however, are pushing back. Because the proposed levy would apply to total assets including shares, real estate, and bank deposits, it would disproportionately affect major corporate owners. Bernard Arnault, chairman of LVMH and France’s richest individual, openly denounced the proposal in an interview with The Sunday Times, calling it “an act of economic sabotage against liberal enterprise.” Arnault, whose net worth currently stands at $169 billion, would owe roughly $3.4 billion annually under Zucman’s plan.

Comment