[China Bio] From Fast Follower to Core Hub, Closing in on the United States

Input

Modified

China sees a surge in new drug clinical trials and global licensing deals Accelerating capture of the global biopharma market through innovation A string of Chinese biotech technology exports, including big-ticket deals with U.S. firms

China’s pharmaceutical and biotechnology industry is positioning itself as a frontline base and core hub for global new drug development. Shedding its outdated image as merely the “world’s factory,” China is reemerging as a source of global biopharmaceutical innovation and consolidating its market influence. Experts say the Chinese government’s persistent push toward technological self-reliance will act as a powerful driver dismantling the United States’ monopolistic position at the top of the global supply chain.

Clinical Trial Infrastructure Reaches World-Leading Scale

According to the global pharmaceutical industry on the 21st, China has established itself as a major innovation powerhouse in new drug development, supported by vast genomic data and the world’s largest clinical trial ecosystem. Beginning with the 12th Five-Year Plan in 2011, China elevated biotechnology and pharmaceuticals to the status of national strategic industries and has continuously nurtured the sector. In 2015, biotechnology was formally designated as one of the “seven strategic emerging industries,” cementing its industrial standing.

The Chinese government’s biotech drive extended beyond regulatory easing. Large-scale expansion of research and development (R&D) investment proceeded in parallel. China’s R&D expenditure ratio rose from around 1% of gross domestic product (GDP) in the early 2000s to 2.68% in 2024, reaching a level comparable to that of the United States. As a result of this sustained support, multinational pharmaceutical companies’ global clinical trials and joint research projects have flowed rapidly into China. Leo Rui, Executive Vice Chairman of the China Pharmaceutical Enterprise Association (CPEA), said, “A decade ago, most newly approved drugs in China were imported by multinational pharmaceutical companies, but of the 78 new drugs approved in China in the first half of last year, 48 were domestically developed,” adding that “government R&D incentives have driven the creation of new drugs.”

Institutional reform was pursued in tandem. By joining the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) in 2017, China secured alignment with global regulatory standards, then rapidly overhauled its clinical trial and approval systems to meet international norms. Around 2018, China fully implemented an “implied approval” system, under which clinical trials automatically commence if regulators raise no objections within a specified period. This significantly shortened the initial timelines required for new drug development. The speed gains are evident in the data. As of 2024, the number of clinical trials registered in the World Health Organization (WHO) international database surpassed 7,100 in China, already exceeding the U.S. figure of approximately 6,000.

Large High-End Talent Pool and Faster Commercialization Further Accelerate Innovation

The return of global talent has also propelled China’s rapid biotech ascent. Over the past decade, large numbers of scientists with experience in the United States and Europe have returned home. Through the “Thousand Talents Plan,” which aimed to attract 1,000 overseas Chinese scholars, more than 7,000 scientists from major pharmaceutical companies are reported to have returned from abroad.

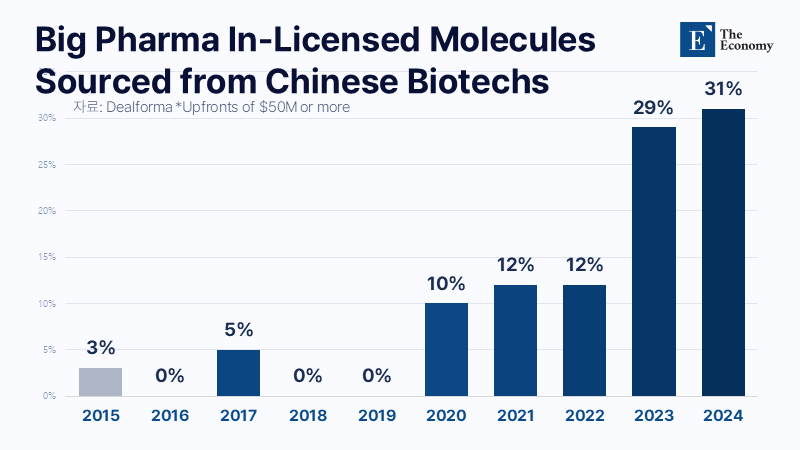

More than ten biotech innovation hubs established across China have also underpinned growth. Supported by concentrated government R&D funding and regulatory innovation, shortened timelines for reimbursement listing of new drugs have accelerated market expansion. The total value of China-originated licensing-out deals has climbed sharply since 2019 and is estimated to have reached around $50 billion in 2024.

The industrial structure is also undergoing rapid upgrading. Moving away from a manufacturing base centered on generics and active pharmaceutical ingredients (APIs), China’s focus is shifting toward high value-added segments such as antibody-drug conjugates (ADCs), bispecific and trispecific antibodies, cell and gene therapies (CGT), and RNA-based therapeutics. Accordingly, major Chinese biotech companies are working to establish integrated “research–development–manufacturing” models that combine in-house pipelines with global technology out-licensing, going beyond contract development and manufacturing organization (CDMO) services.

China’s policy drive to foster the biotech industry remains ongoing. At a State Council executive meeting held late last year, authorities reviewed and passed revisions related to the implementation of the Drug Administration Law, formally advancing improvements to drug development and registration systems and accelerating the review and approval of innovative therapies. China is pushing early commercialization of medicines with high clinical demand through mechanisms such as breakthrough therapy designation, conditional approval, and priority review and approval. At the same time, it is strengthening protection for innovation outcomes by refining clinical trial data protection and market exclusivity systems, while actively encouraging foreign capital investment and R&D participation in pharmaceutical innovation.

Global Big Pharma Sends a Wave of Courtship Signals

China’s advances are translating into commercial success in the technology transfer market. During the world’s largest pharmaceutical and biotech investment event, the JP Morgan Healthcare Conference (JPMHC 2026), held in San Francisco from the 12th to the 16th (local time), a series of major contracts involving Chinese companies were announced. U.S. pharmaceutical company AbbVie signed a technology transfer agreement with Chinese biotech firm RemeGen for the bispecific antibody oncology candidate RC148, in a deal valued at $5.6 billion. RC148 is a next-generation cancer therapy candidate that simultaneously targets PD-1 and vascular endothelial growth factor (VEGF). Under the agreement, AbbVie secured exclusive rights to develop, manufacture, and commercialize RC148 worldwide, excluding Greater China.

Swiss pharmaceutical company Novartis also concluded two in-licensing deals with Chinese companies during the conference. On the 12th, Novartis signed an agreement worth up to $1.7 billion to acquire antibody technology from China-based biotech startup Sineuro Pharmaceuticals for delivering Alzheimer’s disease treatments to the brain. On the 13th, Novartis followed with a deal to in-license a radioligand therapy (RLT) from Zonsen PepLib Biotech. Major pharmaceutical companies, finding it increasingly difficult to source innovation solely within the United States and Europe, are joining forces with Chinese drugmakers in pursuit of commercial value despite the geopolitical risks posed by U.S.–China tensions.

Global big pharma’s attention to Chinese biotech companies dates back to the mid-2010s. At the time, China was still viewed primarily as a manufacturing base for generics and APIs. However, as breakthroughs emerged in areas such as immuno-oncology and cell therapies, exploratory collaborations and points of engagement with global pharmaceutical companies increased. A landmark case came in 2017, when Janssen, a subsidiary of Johnson & Johnson, signed a global co-development and commercialization agreement with China’s Legend Biotech for the chimeric antigen receptor T-cell (CAR-T) candidate LCAR-B38M. Janssen secured global rights excluding Greater China and reportedly paid an upfront fee of $350 million. The asset was later developed into the multiple myeloma treatment ciltacabtagene autoleucel (cilta-cel) and successfully commercialized globally, marking one of the earliest cases in which Chinese biotech technology evolved into a core pipeline asset for global big pharma.

China’s growth momentum is expected to continue. According to global consulting firm McKinsey & Company, China’s pharmaceutical market reached $277.3 billion in 2024. Within this, the innovative drug segment is recording double-digit compound annual growth rates, driving overall market expansion. In the United States, some analysts warn that unless appropriate measures are taken within the next three years, U.S. biopharmaceutical leadership could suffer “irreversible” damage. The U.S. National Security Commission on Emerging Biotechnology (NSCEB) recently published a report noting that China is rapidly narrowing the gap with the United States by strengthening its dominance in pharmaceuticals and biotechnology. The report concludes that after treating biotechnology as a strategic priority for two decades, China is swiftly emerging as a dominant force in the sector. It recommends that the U.S. government invest at least $15 billion over the next five years to attract greater private capital into the domestic biotechnology sector. The NSCEB also projects that if current trends accelerate, Chinese-origin drugs could account for 35% of new drug approvals by the U.S. Food and Drug Administration (FDA) by 2040. This is interpreted as a warning signal that U.S. health security could become dependent on China.