Two Faces of Growth: Taiwan Surges Ahead at 5.3% vs. South Korea’s 1%, Driven by the Semiconductor Divide

Input

Modified

Taiwan nears overtaking South Korea’s growth trajectory

TSMC’s dominance powers Taiwan’s “AI flywheel”

Samsung accelerates to reclaim semiconductor leadership

Major global investment banks now project Taiwan’s economy to expand by an average of 5.3% this year—far outpacing South Korea’s 1.0%—highlighting diverging expectations shaped by the semiconductor gap. The worldwide artificial intelligence (AI) boom and TSMC’s dominance in advanced chipmaking have propelled Taiwan into an “AI flywheel” of sustained growth, while South Korea’s memory-heavy industrial structure has led to stagnation. In response, Samsung Electronics has fired a counterstrike, moving to mass-produce 2-nanometer Gate-All-Around (GAA) chips via its Exynos 2600 and ramping up HBM4 output. With TSMC’s monopoly position facing new pressure, global attention is turning to how this shift could reshape the semiconductor hierarchy.

Economic Gap Widens as Korea Stagnates Around 1%

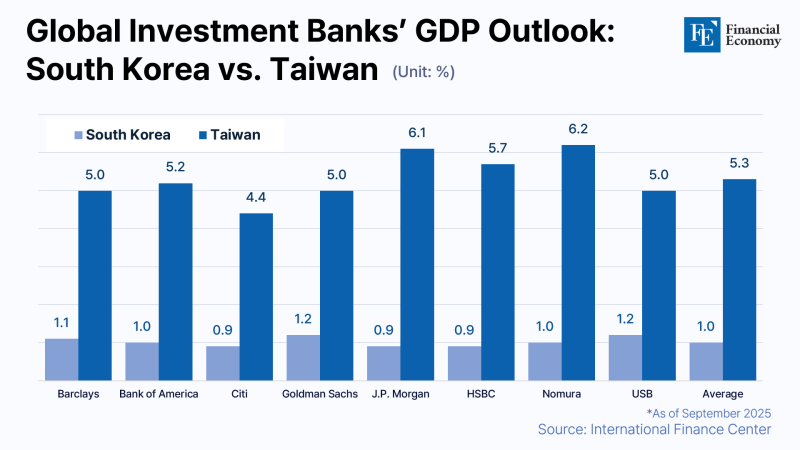

According to the International Finance Center on October 14, the average GDP growth forecast from eight global investment banks (IBs) for Taiwan in 2025 stood at 5.3%, up 0.8 percentage points from August’s estimate of 4.5% and 0.85 points above the Taiwanese government’s 4.45% projection. Nomura raised its forecast sharply from 4.6% to 6.2%, while J.P. Morgan, Bank of America Merrill Lynch, Citi, and HSBC lifted theirs by between 0.3 and 2.4 points. Barclays, Goldman Sachs, and UBS maintained previous estimates, all in the robust 5% range.

The upward revisions stem largely from Taiwan’s surging semiconductor exports. Demand for high-performance chips amid the AI boom has driven a spike in U.S.-bound shipments led by TSMC. In August, Taiwan’s semiconductor exports reached $58.49 billion, surpassing South Korea’s $58.4 billion for the first time. As a result, Taiwan’s real GDP growth in Q2 jumped 8.01% year-on-year, marking its strongest expansion in a decade.

Remarkably, inflation has remained subdued despite this rapid growth. The eight IBs forecast an average 1.7% rise in Taiwan’s consumer prices for 2025, slightly lower than last year’s 2.2%. Analysts attribute this to a stronger New Taiwan dollar, which has appreciated more than 3% year-to-date, boosting foreign-currency inflows and offsetting import-cost pressures.

In contrast, South Korea’s average growth forecast stands at 1.0%, barely escaping sub-zero territory. UBS and Goldman Sachs expect 1.2%, Barclays sees 1.1%, while J.P. Morgan and HSBC project 0.9%, and Citi just 0.8%. Consequently, Korea’s per-capita GDP is expected to reach $37,430, trailing Taiwan’s $38,066 for the first time. With the won-dollar exchange rate hovering near 1,400, IBs warn that the gap could widen further if the currency remains weak.

Semiconductors Anchor Taiwan’s Explosive GDP Growth

Markets widely agree that Taiwan’s rapid ascent reflects structural changes centered on TSMC, the world’s largest foundry and de facto “silicon hub” of the AI era. Local media report that TSMC has already secured most of the 2-nanometer chip orders for 2025 from Apple, NVIDIA, AMD, and MediaTek, with full-scale production expected midyear at its Hsinchu Science Park and Kaohsiung Nanzih facilities.

The so-called “2-nanometer effect” is visible in numbers. Industry analysts expect TSMC’s 2025 revenue to exceed NT$3 trillion (approximately $140 billion), with annual growth topping 20%. Early trial yields at the Baoshan and Kaohsiung 20/22 fabs have already reached nearly 70%, supporting those projections. As transistor widths shrink, power efficiency and processing speeds improve—crucial for AI servers and high-performance GPUs. The Taiwanese government aims to institutionalize this momentum, positioning semiconductors as a growth engine representing over 20% of GDP.

TSMC’s dominance is transforming the broader economy into an “AI flywheel.” Electronics manufacturers such as Foxconn, Quanta, and Wistron have pivoted toward AI server assembly and chip packaging, reporting double-digit revenue increases. In July, Taiwan’s exports surged 42% month-on-month, the steepest rise in 15 years. NVIDIA CEO Jensen Huang recently declared that “the heart of AI power lies in Taiwan”—a sentiment increasingly echoed by markets. The nation’s TSMC-centered industrial ecosystem is now driving a virtuous cycle of manufacturing, exports, and employment.

This growth rests on decades of public-private coordination. Since recruiting Morris Chang to found TSMC in the 1980s, Taiwan’s government has treated semiconductors as a strategic national industry. During U.S.–China trade tensions, it preemptively announced a $165 billion fabrication plant in Arizona to sidestep tariff risks. Those timely strategic decisions have secured Taiwan over 60% of the global foundry market, leading the Center for Strategic and International Studies (CSIS) to call its chips “the oil of the 21st century.”

Samsung’s 2nm Counteroffensive Signals Shift in Competition

Yet as semiconductors now account for over 10% of Taiwan’s GDP, economists warn of an emerging “Icarus risk.” A slowdown in AI chip demand or geopolitical disruptions could abruptly stall growth. Research firm TrendForce cautioned late last month that “AI server shipments are likely to peak this year and slow in 2026.” With chip manufacturing consuming more than 10% of Taiwan’s electricity, water and energy shortages also pose growing threats. These structural risks could fracture Taiwan’s TSMC-centric growth model if left unchecked.

Samsung Electronics aims to exploit this opening. The company plans to mass-produce the Exynos 2600 this year, becoming the first in the world to commercialize 2-nanometer GAA technology. Internal reports indicate that yield rates have improved from 30% to 50% compared to the prior 3nm process, with major efficiency gains. Benchmark tests show single-core scores of 3,309 and multi-core scores of 11,256, matching Qualcomm’s Snapdragon 8 Elite Gen 2, signaling a potential turnaround for Samsung’s struggling System LSI and foundry divisions.

Samsung is also accelerating in high-bandwidth memory (HBM). Having passed NVIDIA’s HBM3E qualification test, it is now poised to supply chips for the upcoming GB300 AI accelerator. The company resolved prior heat issues by redesigning its 12-layer HBM3E using 1a DRAM, and its forthcoming HBM4, based on 1c DRAM, is set for mass production later this year. Samples have already shipped to Qualcomm, OpenAI, and AMD. Industry insiders say that “if TSMC’s technology gap narrows, Taiwan’s growth flywheel could quickly reverse direction—led by South Korea’s Samsung.”