From Tariffs to Tact: Trump Shifts Tone as Beijing Shows Strength

Input

Modified

“Don’t Worry About China,” Trump Signals Softer Stance Beijing Responds With Defiance, Turning Pressure Back on Washington China’s Control of Rare-Earth Supply Chain Undermines U.S. Leverage

U.S. President Donald Trump, who had earlier vowed to impose an additional 100% tariff in retaliation for China’s rare-earth export controls, has abruptly softened his stance. After Beijing declared it would confront Washington’s pressure head-on, Trump shifted to a more conciliatory tone, signaling a desire to prevent further escalation. Analysts say the reversal reflects China’s overwhelming dominance in the global rare-earth supply chain.

Trump Extends an Olive Branch to China

On the 12th (local time), President Donald Trump wrote on his social media account, “Don’t worry about China—everything will be fine.” He added, “President Xi Jinping, a very respected man, is just going through a rough patch. He doesn’t want his country to fall into recession, and neither do I.” Speaking later aboard Air Force One en route to Israel, Trump told reporters, “I think we can do well with China. I have a good relationship with President Xi,” describing him as “a tough, smart man and a great leader for China.”

Markets took note of Trump’s sudden reversal. Just days earlier, China had announced that products made overseas but containing Chinese rare-earth materials would require export approval from Beijing. In response, Trump threatened to impose a 100% tariff on Chinese goods starting in November and tighten restrictions on technology exports. On October 10, he had even told reporters he saw “no reason” to meet Xi at the upcoming APEC summit in Korea, signaling strong disapproval.

Yet by the 12th, his tone had shifted dramatically. When asked whether he still planned to enforce the 100% tariff, Trump replied, “For now, yes,” but added, “November 1 may seem imminent to others, but to me, it’s a long way off”—a remark widely interpreted as leaving room for negotiation before the tariffs take effect.

“We Don’t Want a Fight, But We’re Not Afraid of One”: Beijing Stands Firm

Trump’s conciliatory remarks came less than a day after China vowed to confront Washington’s tariff threats head-on. Before Trump softened his tone on the 12th, a spokesperson for China’s Ministry of Commerce stated, “China’s position on the tariff war has been consistent—we do not seek a fight, but we are not afraid of one.” The spokesperson added, “Since the U.S.–China meeting in Madrid in September, Washington has introduced a series of additional restrictions, adding many Chinese firms to its export control entity list and the Specially Designated Nationals (SDN) list, severely undermining China’s interests and the atmosphere of bilateral trade talks.”

Chinese experts also blamed U.S. export controls for Beijing’s retaliatory rare-earth measures. Wu Xinbo, Dean of the Institute of International Studies at Fudan University, said, “Around 2,000 Chinese firms are already subject to export restrictions, but the new regulations would extend those sanctions to all their subsidiaries, affecting tens of thousands of companies—a highly malicious act.” He added, “Trump is under greater pressure than China, and the U.S. will likely seek a resolution through negotiation.”

Pro-Beijing media echoed this sentiment. In an editorial on the 12th, Hong Kong’s Sing Tao Daily argued that “the U.S. lacks the power to counter China’s rare-earth export restrictions,” recalling that “when China limited exports of seven rare-earth materials in April, Trump was forced to call a truce in May.” The paper added that whether the two leaders will meet later this month—and whether that meeting produces a breakthrough—“depends on whether the U.S. treats China as an equal; otherwise, talks will be meaningless.”

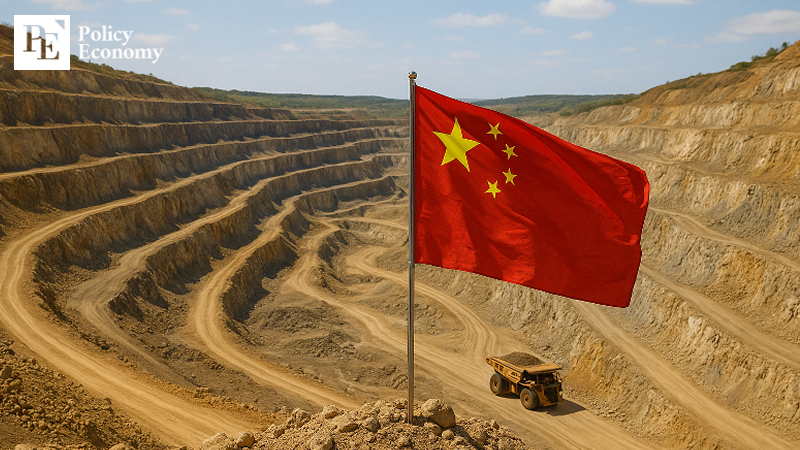

China’s Grip on the Rare-Earth Supply Chain

Trump’s sudden softening toward Beijing is widely seen as a recognition of China’s overwhelming dominance in the global rare-earth supply chain. According to the U.S. Geological Survey, the United States produced around 45,000 tons of rare earths in 2024—second globally but far behind China’s 270,000 tons. America’s only active rare-earth mine, Mountain Pass in California, is partly owned by the U.S. government, which holds a 15% stake and has agreed to purchase its output at double the market price to secure domestic supply. Yet the mine’s annual production of rare-earth permanent magnets is only about 1,000 tons—less than 1% of China’s output.

Compounding the issue, most rare earths mined in the U.S. are still processed in China. Refining rare earths involves separating and purifying mixed elements, a process that releases toxic chemicals, heavy metals, and radioactive substances. To avoid these environmental risks, the U.S. and other Western nations have long outsourced mining and refining operations to China. As a result, China now controls roughly 90% of the global rare-earth refining and separation market and about 93% of the permanent magnet manufacturing market—the final stage of the supply chain.

China’s ongoing decoupling from U.S. trade further weakens the effectiveness of Trump’s pressure tactics. According to China’s General Administration of Customs, exports to the U.S. fell 17% year over year in the January–September period, while total exports rose 6%. This suggests Beijing has partially offset U.S. losses by diversifying trade. During the same period, Chinese exports to the European Union increased by 10%, and shipments to ASEAN markets grew by about 12%, underscoring China’s expanding influence beyond the U.S. market.

Comment