Trump Pushes ‘$2,000 Tariff Dividend’ Amid Supreme Court Review and Mounting Public Backlash

Input

Modified

Conservative justices question legality of tariff policy Trump touts reshoring and anti-China effects Over half of Americans disapprove of his economic management

As the U.S. Supreme Court begins reviewing the legality of tariffs imposed by the Trump administration, President Donald Trump has launched a public campaign defending his trade policies—while floating an idea to distribute tariff revenues directly to citizens as a national “dividend.” Calling the case “one of the most important in American history,” Trump framed tariffs as a pillar of his economic strategy, even as inflation and weakened consumption have fueled growing public discontent. Recent polls show that more than half of Americans now view his economic management negatively, signaling that tariffs may have become a political liability.

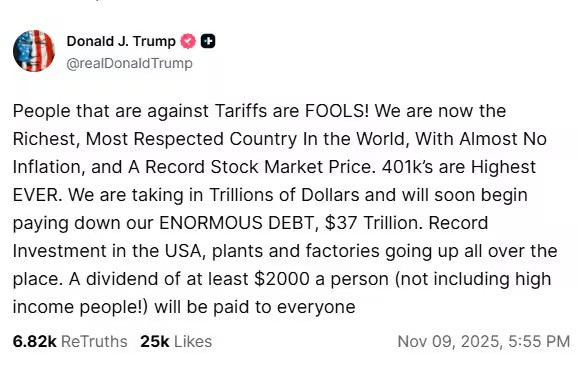

“Anyone Opposed to Tariffs Is a Fool”

According to Politico on November 9, Trump wrote on Truth Social that “people who oppose tariffs are fools,” pledging to pay at least $2,000 to every American except high-income earners. He had made a similar remark in July, boasting that the U.S. was “collecting massive amounts in tariff revenue” and suggesting that “returning part of it to lower-income citizens could be a great idea.”

Politico noted, however, that Trump’s “$2,000-per-person dividend” remains purely conceptual, with no concrete framework in place. Treasury Secretary Scott Bessent told ABC that he “has not yet discussed the plan with the president,” adding that “the $2,000 dividend could take many different forms.” He suggested that tax relief on tips or overtime pay—key elements of the administration’s fiscal policy—might produce similar benefits.

IEEPA Legality at the Core of the Case

Trump’s remarks came as the Supreme Court weighs the legality of his administration’s tariff measures, which were implemented under the International Emergency Economic Powers Act (IEEPA). He invoked the statute—allowing the president to restrict foreign economic activity during national emergencies—to justify sweeping tariffs. Having lost in both lower courts, the administration now faces an uncertain outcome.

Although the Court’s current 6–3 conservative majority might appear favorable to Trump, CNN reported that even some conservative justices voiced skepticism during oral arguments on November 5. The Court’s three liberal justices have already indicated they are unlikely to side with the administration.

In a Truth Social post the same day, Trump called the case “one of the most significant in U.S. history,” asserting that “companies are coming back to America solely because of tariffs.” He questioned whether the Court understood this, adding, “The president has authority to halt all trade with foreign nations, and Congress has approved it. Can’t we even impose simple tariffs for national security reasons?”

Speaking to Fox News on November 8, Trump warned that striking down tariffs “would devastate the United States and plunge the global economy into recession.” He claimed that his tariff threats forced China to lift restrictions on rare earth exports—“a victory for both America and the world.” Treasury Secretary Bessent, in a written submission to the Court, cautioned that if the administration loses the case next summer, between $750 billion and $1 trillion in tariff revenue could be subject to refund claims.

Consumers Shoulder Up to 55% of Tariff Burden

Regardless of the legal outcome, public sentiment toward tariffs has sharply deteriorated. An ABC News–Washington Post–Ipsos poll of 2,725 Americans conducted earlier this month found that two-thirds of respondents believe “the country is heading in the wrong direction,” while fewer than one-third said otherwise.

Sixty percent blamed inflation on Trump’s policies, and dissatisfaction with tariffs, the economy, and federal governance all exceeded 60%. Some 64% said Trump’s expansion of executive authority had gone “too far.”

Overall approval of Trump’s job performance stood at 41%, with 59% disapproval, widening the gap from 16 points in April to 18 points now—double the margin recorded in February. Thirty-seven percent of respondents said their personal finances had worsened under Trump, compared to 18% who said they improved. Economic approval ratings fell to their lowest since his return to office, with just 37% positive versus 62% negative. For comparison, in March 2020—during Trump’s first term—economic approval had stood at 57%.

The growing dissatisfaction reflects the mounting costs borne by consumers. A recent Goldman Sachs report estimated that up to 55% of all tariffs imposed by the Trump administration are being passed on to consumers. The revision of the de minimis threshold last September—now subjecting imports under $800 to tariffs—has reshaped online shopping behavior, driving up both import and domestic prices.

As prices climb and inflation persists, Americans are cutting back not only on foreign online purchases but on overall spending. Major retailers and logistics firms such as Amazon, UPS, and Target have responded with cost-cutting, layoffs, and operational streamlining to offset rising supply-chain expenses and declining domestic demand.

Comment