Robots poised to enter UPS unloading sites as logistics automation enters the “main game”

Input

Modified

Beyond efficiency gains, a shift in fixed-cost structures

Robots deployed for simple, repetitive, standardized tasks

Building essential infrastructure before AI-driven logistics

Global logistics giant UPS is set to introduce sweeping changes on the ground by deploying 400 robots to automate unloading operations. As part of UPS’s mid- to long-term automation strategy, the move is expected to accelerate a shift toward equipment-centered processes in unloading operations that have traditionally relied heavily on manual labor. Beyond UPS, companies such as Amazon are also linking logistics robots to AI-based operating systems, preparing for the post-automation phase of logistics operations.

Companywide capital investment in equipment

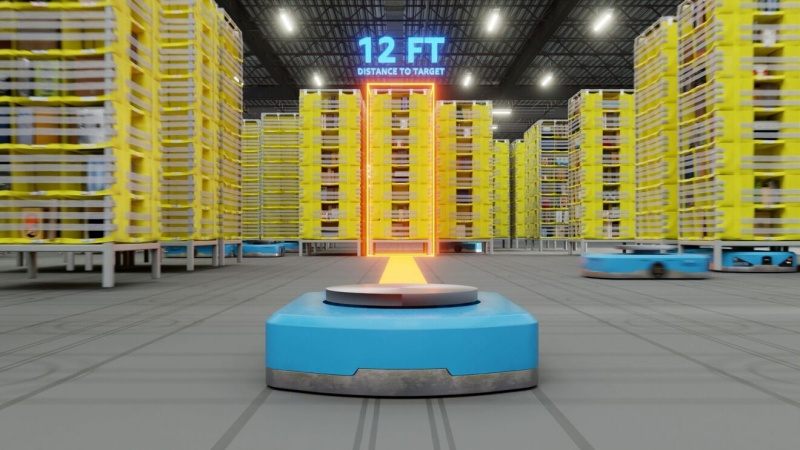

According to Bloomberg on the 16th (local time), UPS recently invested 120 million dollars to purchase 400 robots produced by Pickle Robot Co. for truck unloading automation. Mounted on mobile bases, the robots can autonomously enter containers and use suction grippers to lift boxes weighing up to 50 pounds and place them onto conveyor belts. Rather than serving as auxiliary tools, the robots are capable of replacing entire unloading processes, making the investment a clear escalation in UPS’s logistics automation strategy.

UPS plans to deploy the robots sequentially at major logistics hubs across the United States from the second half of 2026 through 2027. According to Pickle Robot, a single robot can unload a full truck in about two hours, and based on labor cost savings, the investment can be recouped within roughly 18 months. UPS has spent several years since the early 2020s running pilot tests to validate the effectiveness of unloading automation, and this large-scale rollout signals a transition from experimentation to companywide capital investment.

Within the logistics industry, loading and unloading operations are widely seen as pressure points where labor costs, workplace injury risks, and high turnover rates converge. Repetitive handling of heavy cargo inside containers poses significant musculoskeletal injury risks, creating chronic workforce instability. UPS has not been immune to these challenges, particularly since the pandemic, as surging e-commerce volumes compounded difficulties in securing labor while controlling costs.

Against this backdrop, the large-scale robot deployment is being viewed not merely as an efficiency upgrade but as a restructuring of cost fundamentals. UPS has outlined a mid-term plan to invest a total of 9 billion dollars by 2028 to expand automation across more than 60 U.S. facilities, targeting cost savings of around 3 billion dollars. To support this effort, the company has already shuttered operations at 93 facilities this year and cut 34,000 jobs, accelerating efforts to reduce fixed costs.

Humanoids are distant, specialized robots are close

The UPS case also highlights how the center of industrial automation is rapidly shifting away from humanoid robots toward task-specific, purpose-built machines. While humanoids offer versatility, they face clear limitations in cost, reliability, and speed when deployed in industrial settings. In logistics environments, the priority is not complex judgment but the fast, stable repetition of predefined actions under controlled conditions—an area where specialized robots excel.

Logistics sites themselves are well suited for demonstrating the strengths of purpose-built robots. Tasks such as container unloading, pallet stacking, and small-parcel sorting feature clear standards and predictable ranges of weight, shape, and speed. As a result, robots deployed in these environments tend to focus less on general-purpose AI and more on computer vision, sensor-based recognition, and simple but fast mechanical performance.

A representative example is Boston Dynamics’ Stretch robot, adopted by German supermarket chain Lidl. The robot can handle up to 800 boxes per hour, each weighing up to 50 pounds, concentrating on the single task of identifying boxes inside containers and transferring them to conveyors. Based on pilot operations at a Georgia logistics center, Lidl decided to add 22 more units, citing seamless integration into existing infrastructure without large-scale facility modifications as a key factor. This underscores how logistics companies prioritize on-site applicability and return on investment alongside technical sophistication.

U.S. logistics firm Saddle Creek Logistics has similarly automated container unloading and sorting by combining collaborative robots from Japan’s FANUC with mobile robots, reducing processes that once required four to five workers to one or two supervisory staff. The shift has virtually eliminated worker injuries related to heavy lifting and significantly improved stability during night operations. In air logistics, FedEx introduced AI-based sorting robots at its Singapore hub, processing up to 1,000 parcels per hour with accuracy exceeding 98 percent.

Automation → data accumulation → prediction and optimization

Amazon is positioning logistics robots not simply as automation tools but as foundational infrastructure for an AI-driven logistics system. In July, Amazon announced that it had deployed its one-millionth robot across global fulfillment centers, now operating various robot types at more than 300 sites. Robots such as Hercules, which moves loads of up to 1,250 pounds, Pegasus for precision package handling, and the autonomous Proteus are not standalone machines but components integrated into the broader logistics flow.

Amazon’s vision of robots as generators of movement and processing data is clearly reflected in its AI optimization model DeepFleet. The system continuously adjusts robot routes and task sequences across the logistics network, learning from inventory movements, order patterns, and robot traffic data and feeding outcomes back into operations. This marks the point at which logistics robots begin functioning not just as mechanical equipment but as data-collection devices enabling prediction and decision-making.

This shift is not unique to Amazon. Ahead of the Pickle Robot deployment, UPS had already reduced driving distances and fuel consumption through its ORION route optimization system, while DHL has integrated demand forecasting with network risk analysis to guide logistics operations. In South Korea, Coupang and CJ Logistics have also begun linking automated equipment, robotic picking, and AI-based sorting and forecasting into unified operational flows.

Ultimately, logistics robots are less an endpoint than essential infrastructure on the path toward AI-driven logistics. As machines take over repetitive and heavy tasks, data accumulates, and when that data is combined with predictive and optimization capabilities, logistics transitions from a reactive industry to one capable of proactive adjustment. This shift suggests a transformation in labor demand and a competitive landscape moving away from workforce scale toward algorithms and operational design capabilities.

Comment