ChatGPT rolls out a Netflix-style low-cost ad tier—can it become OpenAI’s profitability lifeline?

Input

Modified

ChatGPT rolls out $8-a-month ad-supported plan worldwide OpenAI adopts Netflix-style tiering to expand its paid user base Cash-burn pressure mounts as OpenAI turns to ChatGPT Go as an exit strategy

OpenAI’s ChatGPT is set to roll out a lower-priced subscription plan that includes ads across the world, including South Korea. The idea is to cut the monthly fee to expand the pool of paying users, while generating additional revenue by showing contextual ads to subscribers on the plan. It mirrors the playbook used by Netflix, which drew in large numbers of new users with a low-cost ad-supported tier. The market is watching whether ChatGPT’s new pricing model can become a lifeline for OpenAI as it grapples with rapid cash burn.

ChatGPT Go rolls out to far more markets

On the 17th (local time), OpenAI said it is launching its low-cost, ad-supported subscription plan, “ChatGPT Go,” across countries worldwide. ChatGPT Go is priced at $8 a month, more than half the cost of ChatGPT Plus at $20 a month. OpenAI described ChatGPT Go as a budget plan designed to expand access to its most popular features and help more people use advanced AI services in everyday life.

After first launching ChatGPT Go in India in August last year, OpenAI has been expanding the service in phases across 170 countries. Compared with the free version, ChatGPT Go offers 10 times higher limits for messages, file uploads, and image generation, and applies advanced models such as “GPT-5.2 Thinking” to tasks. Users on the plan, however, will be required to view newly introduced ads. For now, the ads are being piloted only in the United States, and are expected to be rolled out to other countries over time.

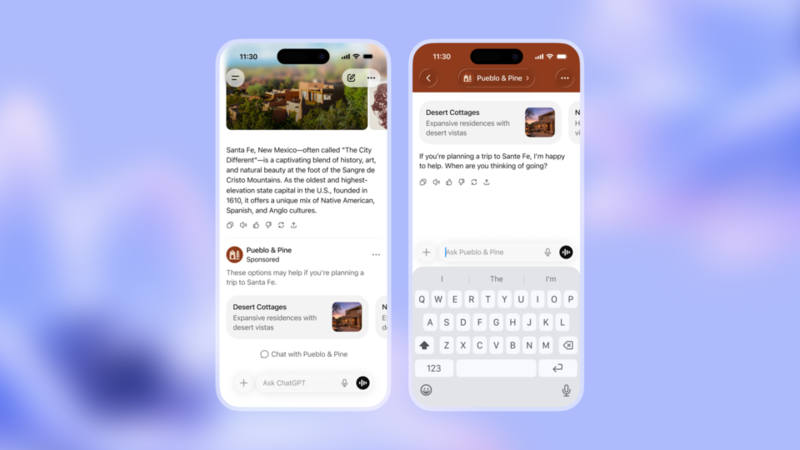

ChatGPT Go’s ads will be shown in a contextual format similar to search engines. When users ask about a specific product or service, links to related sponsors will appear below the response. OpenAI said ads will not influence the content of answers and will be presented separately from standard responses. It also said it will not sell users’ raw conversation text directly to advertisers, and introduced guidelines that block ads entirely for accounts under 18 and for conversations involving sensitive topics such as health, mental health, and politics.

Netflix’s ad-supported pricing strategy

Analysts say ChatGPT’s tiered pricing strategy echoes Netflix’s playbook. Netflix first introduced an ad-supported plan in November 2022, offering viewers a cheaper subscription in exchange for watching 15- or 30-second ads. In the U.S., Netflix’s ad-supported tier costs $7.99 a month, far below the cheapest ad-free plan at $17.99.

The ad-supported tier significantly lowered the barrier to entry for Netflix, which in turn helped expand its user base. At an event for advertisers last May, Netflix said its ad-tier monthly active users (MAU) had reached 94 million, up by about 20 million in roughly six months from 70 million in November. Netflix also said the ad tier has attracted more 18–34-year-old subscribers than other U.S. broadcasters or cable networks, and that these users spend an average of 41 hours per month on the service.

Netflix is also pushing to improve profitability with its in-house advertising platform, the “Netflix Ads Suite.” The platform is designed to let advertisers target more than 100 interests across over 17 categories. Netflix says the technology increases the relevance between on-screen content and ads, boosting viewer attention. Amy Reinhard, Netflix’s president of advertising, said viewers’ attention to ads “starts higher and ends much higher” than peers, adding that subscribers focus on mid-roll ads to a degree comparable to how they engage with the shows and films themselves.

Funding pressure facing OpenAI

The industry expects that if ChatGPT Go manages to gain traction the way Netflix’s ad-supported tier did, OpenAI’s profitability could improve markedly. For now, OpenAI is burning through cash at a rapid pace as it continues aggressive investment. The Information estimated in September last year that OpenAI’s cumulative cash burn could reach $115 billion by 2029. Fortune reported in November that OpenAI is expected to spend $9 billion out of projected $13 billion in revenue this year, implying a cash-burn ratio of around 70%.

On the 17th, The New York Times, citing analysis by Sebastian Mallaby, an economist at the Council on Foreign Relations, reported that OpenAI could face a bankruptcy risk by mid-2027 as it burns cash far faster than it generates revenue in the race to develop AI. Mallaby noted that under CEO Sam Altman, OpenAI has pursued aggressive investment, including computing contracts totaling $1.4 trillion over eight years, but warned that such spending makes it difficult to bridge the financial gap given the company’s goal of achieving profitability by 2030.

Mallaby also argued that the key question is not whether consumer-facing AI will take hold technologically, but whether its economics are viable over the medium to long term. Many AI companies, including OpenAI, are burning cash at an unsustainable pace relative to weak profitability. While big tech firms such as Microsoft and Meta have multiple cash-cow businesses beyond AI, most younger AI companies—including OpenAI—rely almost entirely on AI as their sole source of revenue. That leaves them with far less room to wait for AI investments to pay off compared with established tech giants.