Japan’s LDP Secures Record-Breaking Seat Count on “Strong Japan” Platform, Markets Turn Alert as Political Weight Shifts

Input

Modified

Most powerful executive branch to date takes shape

“Takaichi power” fuels prospects of long-term rule

Yen weakness, fiscal sustainability debate moves to forefront

Japan’s ruling Liberal Democratic Party (LDP) scored a landslide victory in a snap general election, forming the strongest seat configuration in postwar Japanese political history. It is the first time since World War II that a single party has secured more than two-thirds of parliamentary seats, and the result is widely seen as a defining moment in Japan’s political realignment. The U.S. government promptly issued congratulatory messages and referenced deeper bilateral cooperation, underscoring the diplomatic implications of the outcome. Markets, meanwhile, are closely watching the potential fallout—from yen weakness to volatility in interest rates and equities—triggered by the election result.

Signal of Enhanced External Standing

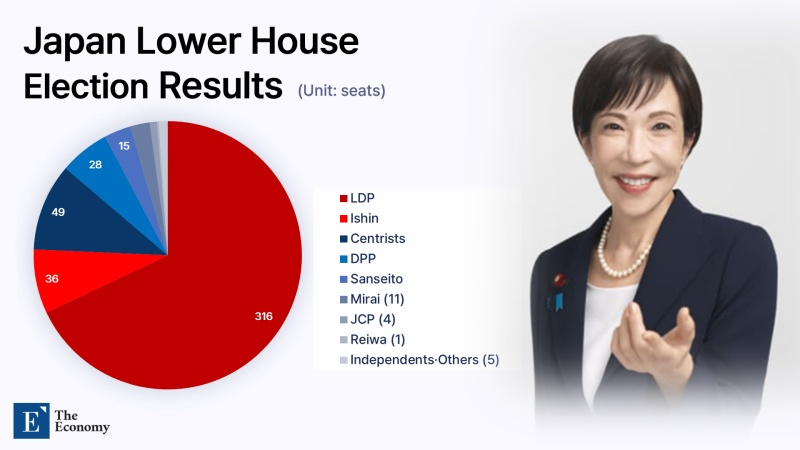

According to Kyodo News and NHK, the LDP captured 316 of the 465 seats in the House of Representatives election held the previous day. This represents an increase of 128 seats from its previous 198 and surpasses the party’s prior record of 304 seats set in the 1986 general election under the Yasuhiro Nakasone administration, the highest since the party’s founding in 1955. Former Prime Minister Shinzo Abe also led the LDP to repeated electoral victories after returning to power in 2012, but the party’s seat count never exceeded 300 during that period.

The LDP’s 316 seats exceed the constitutional amendment proposal threshold of two-thirds (310 seats). Combined with coalition partner Nippon Ishin no Kai, which increased its seats from 34 to 36, the ruling bloc now controls 352 seats. By contrast, the centrist reform alliance—the largest opposition group that previously held 167 seats—secured only 49 seats in this election. The alliance, formed just ahead of the vote by the Constitutional Democratic Party and Komeito, won only seven of the 289 single-member districts. Following the defeat, Yoshihiko Noda, co-leader from the Constitutional Democratic Party, announced his intention to step down.

Abroad, the election result is being interpreted as a major turning point in Japanese politics. U.S. Treasury Secretary Scott Bessent posted on social media platform X, congratulating Prime Minister Sanae Takaichi on what he called a “historic victory with the largest postwar margin.” He added, “A stronger Japan makes America stronger in Asia,” emphasizing that the strong relationship between Prime Minister Takaichi and President Trump “demonstrates the enduring bond between our two countries.” A U.S. State Department spokesperson also told Nikkei that “the U.S.-Japan alliance remains the cornerstone of peace, security, and prosperity in the Indo-Pacific, and is stronger than ever.”

Ahead of the election, U.S. President Donald Trump had publicly stated that he “fully and unequivocally supports” Prime Minister Takaichi and the LDP–Nippon Ishin coalition. It is highly unusual for a sitting U.S. president to openly endorse specific parties and a governing coalition ahead of a Japanese national election, signaling that Washington views the outcome through the lens of bilateral relations and Indo-Pacific cooperation. This context explains why the LDP’s sweeping victory is being assessed as more than a purely domestic political event.

Low Probability of Constitutional Revision in the Short Term

Japan’s government is currently moving to revise three core national security documents within the year to strengthen defense capabilities and plans to abolish certain weapons export restrictions in 2024. With the ruling bloc surpassing the threshold to independently initiate constitutional amendments, speculation has emerged that Japan could pursue revisions to Article 9 of the Constitution, effectively transforming the country into a de facto “war-capable state.” However, such moves are unlikely to materialize quickly. Constitutional amendments require two-thirds approval in both the House of Representatives and the House of Councillors, and the latter remains under opposition control. The next House of Councillors election is scheduled for the summer of 2028.

Even so, the election is widely regarded as a milestone that significantly boosts the prospects of long-term rule under Prime Minister Takaichi. Securing enough seats to independently propose constitutional amendments signals political stability over the coming years. Appearing on NHK after the landslide was confirmed, Prime Minister Takaichi said that what she sought the public’s judgment on was “a major shift in economic and fiscal policy—namely, responsible proactive fiscal policy.” She also suggested that most cabinet ministers would remain in their posts in the new cabinet set to launch on the 18th, while refraining from comments on constitutional revision—an approach interpreted as prioritizing continuity in governance.

Major media outlets pointed to Prime Minister Takaichi’s influence as the primary driver behind the shift in political weight between the ruling and opposition camps. Determining that her political footing was unstable—with the combined LDP and Nippon Ishin seat count in the House of Representatives barely exceeding a simple majority at 233—Takaichi abruptly dissolved the lower house on the 23rd of the previous month. Initial polls showed a roughly 10% drop in cabinet approval ratings and growing negative sentiment toward the dissolution decision. As the campaign unfolded, however, Takaichi’s strong personal approval ratings and name recognition re-emerged, translating into voter support for the LDP in closely contested districts.

Support among younger voters was particularly striking. In a Fuji News Network (FNN) poll conducted late last month, approval for Prime Minister Takaichi among those aged 18–29 reached 88.7%. An NHK survey at the time of her cabinet’s launch showed approval among those aged 18–39 at 77%, far exceeding the 38% recorded under the Shigeru Ishiba cabinet and the 51% under the Fumio Kishida cabinet. Reuters noted that “Prime Minister Takaichi, campaigning under the banner of a ‘Strong Japan,’ has gained attention among younger voters through a blend of consumption-driven enthusiasm and fan culture, a phenomenon that influenced the House of Representatives election outcome.”

Focus Shifts to Long-Term Government Bond Yields

Attention is also focused on the potential impact of the LDP’s landslide on financial markets. During the campaign, the party pledged “responsible proactive fiscal policy,” committing to both crisis-response spending and growth-oriented investment. The strategy centers on boosting employment and income through targeted investments in economic security, artificial intelligence (AI), semiconductors, quantum technology, and content industries, ultimately achieving what it terms a “robust economy.” The party also promised to accelerate discussions on exempting food products from consumption tax for two years. Once the election outcome was confirmed, markets quickly began pricing in expectations of fiscal expansion.

In the equity market, investors are assessing the potential for sector-specific differentiation based on policy direction. Shinichi Ide, chief equity strategist at Nissay Asset Management, said, “We are seeing signs of capital flowing into defense-related stocks as well as food companies expected to benefit from consumption tax cuts,” adding that “if expectations for a recovery in domestic consumption rise, capital could increasingly shift toward food and retail sectors.” He also noted that revisions to the three core security documents and the easing of weapons export restrictions—both directly linked to defense strengthening—could improve earnings visibility for defense-related firms.

In the foreign exchange market, the prevailing view is that yen weakness will persist for the time being. Mark Chandler, chief market strategist at Bannockburn Capital Markets, said, “The near-term trend is likely to continue probing further yen weakness and dollar strength.” Indeed, the yen–dollar exchange rate closed last weekend at 157.20 yen, rebounding by about five yen from the post–“rate check” low of 152.10 yen per dollar following scrutiny by U.S. authorities. The 160 yen per dollar level is widely regarded as a psychological defense line for Japanese authorities, and market vigilance toward potential intervention is expected to intensify as the rate approaches that threshold.

In the bond market, the trajectory of long-term government bond yields is the key variable. A sharp rise in super-long-term yields—highly sensitive to concerns over fiscal deterioration—could transmit upward pressure across other maturities, weighing on equities more broadly. Conversely, some argue that the LDP’s expanded majority reduces the need to accommodate opposition calls for excessive fiscal expansion, potentially easing upward pressure on yields over the medium to long term. Nikkei reported that “interest rates are likely to fluctuate depending on the pace and feasibility of deliberations over food consumption tax cuts,” highlighting the risk that policy details could amplify bond market volatility.

Comment