Europe’s Venture Market Reallocates Capital to AI and Defense, Global Market Shows “Selective Rebound”

Input

Modified

Capital Inflows Surge into AI and Defense Amid Push for Security Sovereignty

Shift from IPOs to PE Exits Reshapes Investment Landscape

Global Venture Investment Rebounds from 2023 Trough

Last year, Europe’s venture capital market rebounded to its highest level since the COVID-19 pandemic, with a notable shift in the qualitative composition of capital flows. Roughly one-third of total investment was directed into artificial intelligence (AI), while defense sector funding also rose sharply in line with rearmament trends. The expansion of capital recovery through private equity (PE) channels, amid a subdued IPO market, is seen as a key driver of this shift. Although global venture investment reached unprecedented levels, capital was concentrated primarily in AI rather than broadly distributed across industries.

Contraction Outside AI, Defense, and Biotech

According to global market analytics firm PitchBook, total European venture capital investment last year rose 5% year-on-year to $78.54 billion, marking the highest level since the pandemic. Of this, approximately $27.97 billion, or about 33%, flowed into AI. In terms of deal count, AI-related transactions represented 33.7% of total deals, up 6 percentage points from 27.7% the previous year. AI has emerged as the central axis of Europe’s venture market in both investment volume and transaction count.

The AI concentration was also evident in large-scale transactions. In September last year, French large language model developer Mistral AI secured approximately $2.02 billion in a Series C round. In the same month, infrastructure firm Nscale completed an $11 billion Series B round. Capital flowing into AI effectively underpinned overall market performance. PitchBook noted that excluding AI investments, European VC funding would have declined by 5.7% last year, describing the trend as one in which growth in a specific sector masked contraction in others.

Outside AI, the security and defense sector recorded meaningful growth. A joint study by data analytics firm Dealroom and the NATO Innovation Fund found that European defense and security technology investment reached $8.7 billion last year, up 55% year-on-year and marking a record high. German drone maker Helsing and Quantum-Systems each raised approximately $1.19 billion. Satellite launch vehicle company Isar Aerospace is reportedly in talks to secure additional funding at a valuation of approximately $1.01 billion.

Biotech also showed signs of recovery. According to HSBC research, healthcare venture investments in the U.S. and Europe totaled 2,167 deals last year, amounting to $60 billion. Investment peaked at $90 billion in 2021 before declining to $44 billion in 2023. The trend reversed in 2024, rising 23% year-on-year to $54 billion, and continued to grow 11% last year.

As capital consolidates around strategic technologies and security sectors, concerns about overheating have emerged. PitchBook senior analyst Nivina Rajan stated that AI’s share of European VC investment could exceed 50% by year-end, warning that concentration in a narrow set of sectors could amplify systemic shocks during a correction phase. Demis Hassabis, CEO of Google DeepMind, also cautioned that signs of overheating in parts of the AI industry increasingly resemble a bubble.

A “$1 Trillion Race” to Rebuild Defense

Despite such concerns, market conditions remain favorable for venture investment. Large PE firms have stepped in to fill the gap left by a prolonged IPO slowdown. Vista Equity Partners acquired AI-based employee experience software company Nexthink for approximately $3.09 billion. Vector Capital purchased Belgian revenue management firm Showpad for approximately $1.12 billion. Corsair Capital acquired AI-based identity verification startup IDnow for $295 million.

With PE-driven mergers and acquisitions emerging as key exit channels, PE buyout exits for VC-backed European startups reached approximately $22.61 billion last year, up more than 35% from approximately $16.78 billion the previous year. In contrast, IPOs declined from 181 in 2024 to 115 last year. Approximately 90% of listed companies were profitable, reflecting a shift toward prioritizing earnings and cash flow, making it more difficult for growth-focused firms to access public markets.

Geopolitical factors have further accelerated capital realignment. Following Russia’s invasion of Ukraine, the EU announced a rearmament plan of up to approximately $952 billion. Tensions with the United States have also intensified. In January, U.S. President Donald Trump signaled intentions regarding Greenland’s ownership and warned of additional tariffs against eight European countries opposing the move, prompting the EU to respond with its Anti-Coercion Instrument. These developments have reinforced efforts across Europe to retain capital domestically in defense and strategic industries.

This shift is reflected in defense spending figures. According to the International Institute for Strategic Studies (IISS), Europe’s defense budget reached approximately $560 billion last year, nearly double the level a decade ago, and is projected to reach 80% of the U.S. Department of Defense budget by 2035. German tank manufacturer Rheinmetall has opened 16 new plants since February 2022, while Italian aerospace company Leonardo has expanded its workforce to 64,000 within two years. Europe’s largest missile maker MBDA increased monthly production of its short-range air defense missile “Mistral” from 10 units to 40 units.

Persistent Capital Concentration Despite Market Recovery

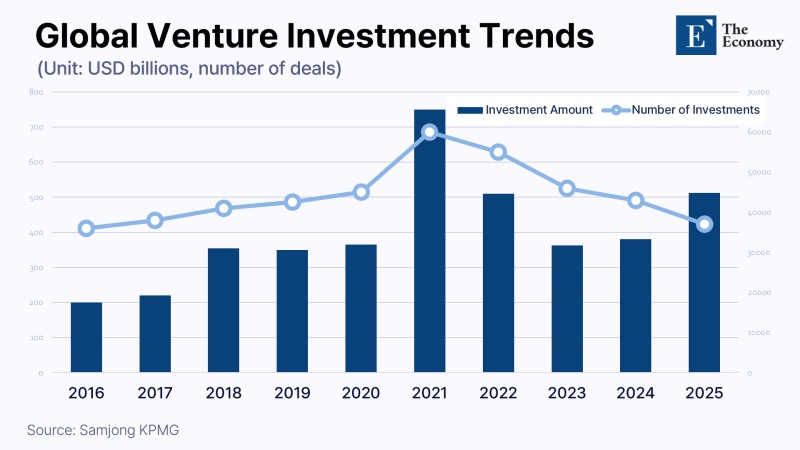

The rebound in venture investment extends beyond Europe. According to a recent report by Samjong KPMG, global venture investment totaled $512.1 billion last year, up 30.7% from $391.9 billion the previous year, marking the third-largest annual total in history. However, the total number of deals declined from 42,366 to 37,746, down more than 11%, underscoring a deepening concentration of large-scale capital into high-quality firms.

AI remained at the center of capital flows. The software sector attracted $240 billion, with a substantial portion directed to AI companies, accounting for 46.8% of global venture investment. The report noted that capital flows, once concentrated in large language models (LLMs), have expanded since 2024 into data centers, small language models (SLMs), robotics, and vertical AI applications, reflecting diversification within the AI ecosystem and a corresponding expansion in capital absorption.

Major funding rounds were dominated by AI firms. In March last year, OpenAI raised $40 billion in a round led by SoftBank. Anthropic secured a total of $16.5 billion across two rounds, achieving a valuation of $183 billion. Other notable deals included Scale AI at $14.3 billion, xAI at $10 billion, and Databricks at $4 billion. Despite the rebound in total investment, the decline in deal count reflects capital concentration in a limited number of firms.

Regional data further highlight this concentration. Venture investment in the Americas reached $342.6 billion last year, up 60.6% year-on-year and accounting for 66.9% of total global venture funding. In contrast, the Asia-Pacific region recorded $79.7 billion, down 14.9% from the previous year. The current recovery phase thus appears driven largely by AI-focused capital concentration and strategic acquisitions, rather than a broad-based revival across industries.

Comment