Nvidia Ushers In ‘Made-in-USA Era’ as Semiconductor Supply Chain Shifts to America

Input

Modified

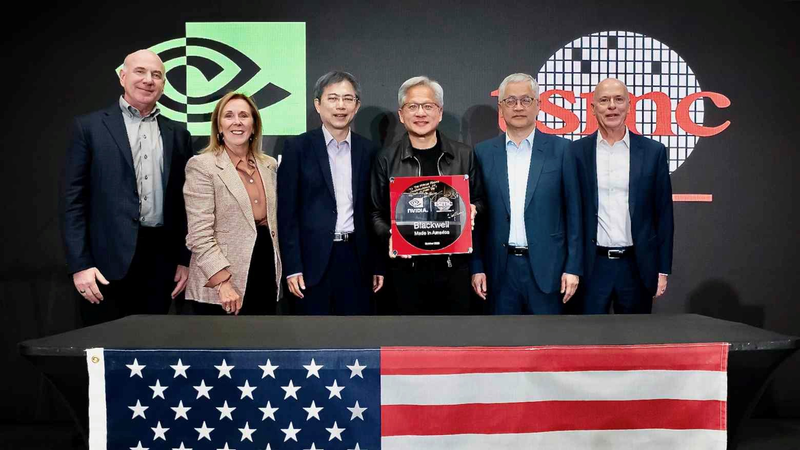

Blackwell GPU Mass Production Begins at TSMC Arizona Plant U.S. Establishes Full Semiconductor Supply Chain from Design to Packaging Global Chip Value Chain Leadership Moves Away from East Asia

Nvidia has begun mass production of its advanced Blackwell GPU at TSMC’s Arizona plant, marking a major milestone in the company’s plan to localize its entire production ecosystem—from design and fabrication to packaging—within the United States. The move aligns with President Donald Trump’s reshoring strategy to bring key industries back to American soil. Under a combination of high tariffs and aggressive investment incentives, major Korean and Taiwanese chipmakers have ramped up U.S. investments, accelerating the transfer of the semiconductor value chain from East Asia to America.

U.S. Semiconductor Investment to Outpace Rivals by 2027

According to SEMI (the Semiconductor Equipment and Materials International) on October 21, U.S. semiconductor investments are projected to surge from $21 billion in 2025 to $33 billion in 2027 and $43 billion in 2028. Between 2027 and 2030, total U.S. semiconductor investment is expected to reach $158 billion. Clark Cheng, Director at SEMI, noted that “based on confirmed semiconductor manufacturing investment contracts, the U.S. will surpass Korea, Taiwan, and China in total investment starting in 2027.”

This rapid investment expansion reflects both government incentives and participation by global corporations. The former Biden administration classified semiconductors as a national security priority during the pandemic-induced supply chain crisis of 2021. The CHIPS Act, enacted in 2022, provided subsidies to major firms to expand U.S. manufacturing capacity. President Trump, since taking office earlier this year, has doubled down on semiconductor self-reliance, coupling steep tariffs with tax benefits to compel global firms to build in America.

Currently, U.S. semiconductor investment is being driven by firms from Taiwan, the U.S., and Korea. TSMC has expanded its U.S. investment commitment from $65 billion to $165 billion, constructing six fabrication plants and an advanced packaging facility in Arizona. Intel is investing $100 billion to build next-generation chip campuses, while Samsung Electronics is spending $37 billion on a foundry in Taylor, Texas. SK Hynix is building an advanced packaging plant in Indiana at a cost of $3.87 billion.

Nvidia to Boost Domestic Production to $500 Billion

On October 17, Nvidia officially began producing its Blackwell GPU at TSMC’s Arizona facility. Previously manufactured exclusively in Taiwan, this marks the first time the chip will also be produced on U.S. soil. “For the first time ever, the most important single chip in the world is being produced in a state-of-the-art U.S. facility,” Nvidia CEO Jensen Huang said at the ceremony. “This represents the realization of President Trump’s vision for industrial reinvention.”

The move signals Nvidia’s pivot toward securing domestic technological resilience and supply chain stability. The company has been hit hard by U.S.–China trade restrictions: unable to export high-end GPUs to China, it lost one of its largest revenue sources, while China’s push for semiconductor self-sufficiency further complicated the landscape. As a result, Nvidia has effectively withdrawn from what was once its biggest market.

Mass production of the Blackwell chip thus symbolizes the beginning of advanced GPU manufacturing in the U.S. However, because TSMC’s advanced CoWoS packaging technology is not yet available domestically, final assembly of AI accelerators must still pass through TSMC’s facilities in Taiwan. Over the next four years, Nvidia and its partners plan to produce $500 billion worth of AI chips and servers. U.S.-produced Blackwell chips will be packaged, assembled, and tested domestically through partnerships with firms such as Amkor and SPIL.

For TSMC, local production offers the added benefit of avoiding tariffs on semiconductor imports imposed by the Trump administration. The company plans to produce AI, communications, and high-performance computing chips at its Arizona site using 2–4 nm processes and is also moving forward with a second fabrication plant there. “To meet surging AI demand, we have purchased land in Arizona to expand production facilities,” said TSMC Chairman Mark Liu on October 17, adding that the company plans to build a giga-fab capable of producing over 100,000 wafers per month.

Korean Chipmakers Poised to Benefit from Localized Big Tech Demand

The shift of advanced chip manufacturing capacity to the U.S. presents both opportunities and challenges for Korean semiconductor firms. As U.S. Big Tech companies increasingly favor suppliers with local manufacturing capabilities, Samsung Electronics and SK Hynix face mounting pressure to stabilize their U.S. production lines quickly. Analysts note that the faster they can ensure stable, high-quality local output, the more likely they are to secure major customers.

To that end, Korean firms are accelerating their deployment of cutting-edge processes. Samsung’s Taylor facility will serve as its U.S. foundry hub, focusing on advanced nodes unlike its older Austin plant. The company is currently installing 2 nm production equipment for mass output targeted next year. The 2 nm process—commercialized only recently—is used by just two companies globally: Samsung and TSMC. Production of Tesla’s next-generation AI6 chip is expected to begin at the Taylor plant next year, likely using the 2 nm node.

Taiwan, meanwhile, remains committed to a “homeland-first” policy. TSMC has already introduced 2 nm technology at its domestic fabs—more than two years ahead of its U.S. rollout—and plans to allocate only 30% of total output to the U.S. even after mass production begins there. This contrasts with Samsung’s approach of building simultaneous 2 nm lines in Korea (Hwaseong) and the U.S. (Taylor). The strategy is also linked to Taiwan’s security calculus: maintaining critical chip production at home reinforces U.S. commitment to defend the island in the event of military aggression from China, industry officials note.

Although TSMC still leads in process technology and yield rates, experts say Samsung could benefit as major foundry clients—under U.S. policy pressure—pivot toward American-made components. As demand for U.S.-produced semiconductors rises, Samsung’s strategic value is climbing accordingly. Tesla CEO Elon Musk, referring to his $16.5 billion foundry deal with Samsung, said its “strategic importance cannot be overstated.”

Comment