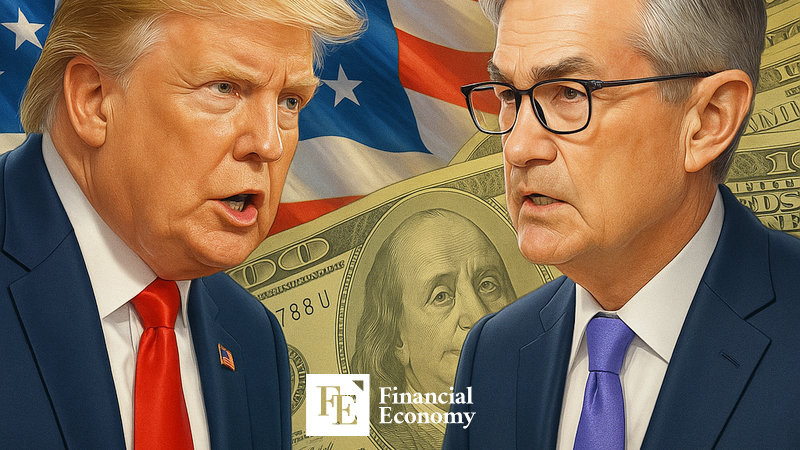

U.S. Begins Selection Process for Next Fed Chair, Renewing Controversy Over Political Interference Under Trump-Aligned Candidates

Input

Modified

Kevin Hassett Emerges as Frontrunner for Fed Chair Post Fed Governor Christopher Waller Also Considered for His Pro-DeFi Views Concerns Mount Over Trump’s Growing Grip on Central Bank Independence

The shortlist for the successor to Jerome Powell, whose term as Chair of the U.S. Federal Reserve (Fed) expires in May next year, has been unveiled. The appointment—one of the most consequential policy decisions of President Donald Trump’s second term—will determine the leadership of the world’s most influential central bank. Given Trump’s frequent clashes with Powell over monetary policy throughout his first term, analysts expect the president to favor a “pro-Trump” candidate aligned with his economic agenda.

Bessent: “Final Decision on Fed Chair by Year-End”

According to Axios on the 28th (local time), Treasury Secretary Scott Bessent told reporters that “a final shortlist of five candidates has been confirmed,” adding that “President Trump will make his decision by the end of the year.” He said second-round interviews would be held next month, and the final list would be presented to the president after Thanksgiving. Powell’s term officially ends in May.

The five final candidates named by Bessent include Kevin Hassett, Chair of the White House National Economic Council (NEC); Fed Governor Christopher Waller; former Fed Governor Kevin Warsh; Rick Rieder, Chief Investment Officer (CIO) for Global Fixed Income at BlackRock; and Michelle Bowman, Fed Vice Chair for Supervision. Among them, Hassett is seen as the closest to President Trump, having held senior positions during both of Trump’s terms and having worked for Jared Kushner’s private equity fund between those stints.

Waller and Warsh—both appointed by Trump during his first term—are regarded as ideologically aligned with the administration’s financial policy stance. Waller, a former vice president of the St. Louis Fed, has voiced support for embracing decentralized finance (DeFi) within the regulatory framework. According to prediction market platform Polymarket, Hassett currently leads with a 36% probability of nomination, followed by Waller at 23% and Warsh at 16%.

Trump’s Renewed Pressure Campaign on Interest Rate Cuts

As the appointment process unfolds, concerns are mounting across financial circles about the erosion of the Fed’s independence. During his first term, Trump dismissed then-Fed Chair Janet Yellen and appointed Powell, but tensions escalated when the Fed raised rates four times in 2018. Trump openly pressured Powell to cut rates and even floated the idea of firing him. The conflict has persisted into Trump’s second term. In August, Trump publicly derided Powell on social media as a “stubborn fool,” once again demanding immediate rate cuts.

Experts interpret Trump’s persistent pressure as a bid to lower borrowing costs and amplify economic stimulus amid ballooning federal debt. The International Finance Center noted, “With U.S. government debt surging rapidly, the risk of implementing financial repression measures is increasing.” It added that the recently passed One Big Beautiful Bill Act (OBBBA)—a massive fiscal stimulus package designed to sustain growth—will inevitably expand federal debt levels.

However, critics warn that such moves go beyond cyclical stimulus and fundamentally undermine the Fed’s institutional independence. A CNBC poll conducted last month found that 82% of respondents believe Trump’s actions are intended to curtail or eliminate the Fed’s autonomy. Central bank independence is regarded as essential to insulating monetary policy from political interference, allowing difficult but necessary decisions for economic stability. Its erosion, economists caution, could trigger inflationary pressures, higher unemployment, and a weakening of the U.S. dollar.

Trump Nominates Trusted Adviser Steven Miran to Fed Board

Despite the controversy, Trump continues to expand his influence over the central bank. In August, following the resignation of Biden-appointed Fed Governor Adriana Kugler, Trump nominated Steven Miran, Chair of the White House Council of Economic Advisers, to fill the vacancy. Miran, one of Trump’s longtime economic advisers, previously served as a senior aide to former Treasury Secretary Steven Mnuchin during Trump’s first term. His appointment would complete the remainder of Kugler’s term, ending January 31 next year.

Associated Press highlighted concerns over Miran’s prior statements that could further politicize the Fed. In a paper co-authored with the Manhattan Institute last year, Miran argued for strengthening presidential control over the central bank. Lawmakers have also criticized his decision to remain on unpaid leave from his White House post, calling it a blatant conflict of interest. Senate Majority Leader Chuck Schumer said ahead of Miran’s confirmation hearing, “He is nothing more than a mouthpiece for President Trump.”

Internal dissent within the Fed has also grown as Trump-appointed governors diverge from the Board’s consensus. The Fed’s policy rate decisions are typically unanimous, but last month both Waller and Bowman voted for rate cuts—marking the first split vote since 1993. The tension escalated further after Trump moved in August to dismiss Governor Lisa Cook over alleged mortgage fraud. Cook, notably, was the first Black woman ever appointed to the Federal Reserve Board.

Comment