Samsung’s 60% DDR5 Price Hike: AI Demand Surge and China’s Rapid Catch-Up Create a Market Turning Point

Input

Modified

AI server demand triggers a supply shock

China accelerates both DDR5 and HBM

Samsung accelerates investment and transition together

Samsung Electronics has raised inter-company contract prices for major DRAM products—including DDR5—by as much as 60% in just two months, sending shock waves through the global memory market. As Chinese firms push aggressively into DDR5 and prepare for HBM mass production, Samsung is expanding large-scale investment around next-generation production sites. Industry analysts now expect a simultaneous price surge in commodity DRAM, a rapid generational shift, and restructuring of the supply chain together redefining the medium-term equilibrium of the memory market.

149 → 239 dollars in two months

Reuters reported on the 16th (local time) that Samsung raised November contract prices for DDR5 DRAM by up to 60%. The 32GB DDR5 RDIMM module used in servers now costs around 239 dollars, up sharply from 149 dollars in September. This rapid rise has strengthened the view that DDR5 has entered a full-scale supply-tightening phase.

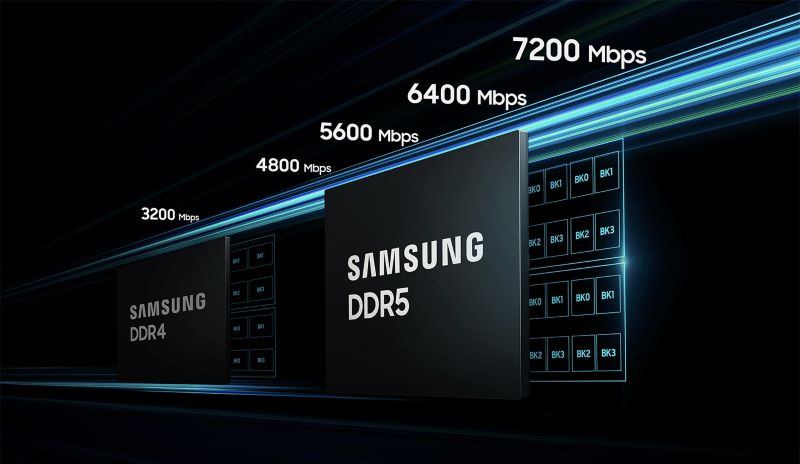

A key driver of the surge is the far faster-than-expected expansion of AI data-center capacity. Although the importance of HBM used in Nvidia GPUs has been widely highlighted, the equally essential role of DDR5 in AI server configurations has been largely overlooked. While GPUs handle computation, CPUs and the memory subsystem require both HBM and high-capacity DDR5. As AI companies escalate model-scale competition, server configurations have grown dramatically in size, pushing DDR5 into a structural shortage.

Another constraint is the industry-wide process shift. The three major DRAM producers, Samsung, SK hynix, and Micron, are reallocating large portions of commodity DRAM lines toward HBM to meet soaring orders. HBM3E and other advanced versions require roughly three times more wafers than DDR5 of the same capacity and take longer to process because of complex TSV stacking steps. As manufacturers prioritize higher-margin HBM, DDR5 output has inevitably fallen behind.

Reflecting the worsening imbalance, TrendForce raised its Q4 DRAM contract-price forecast from an 8–13% rise to 18–23%. Such a large upward revision suggests that supply tightness will not ease quickly. TrendForce added that DDR5 shortages could persist until mid-2026 and warned that cloud-service providers and consumer markets may face cascading price pressures.

China’s memory makers accelerate their climb

China’s rapid transformation of its memory industry has emerged as another major variable. Chinese IC exports rose 24.7% in January–October from a year earlier, reaching 79.45 billion dollars. As OpenAI, Microsoft, Amazon, and other big tech firms absorb roughly half of global DRAM output, Chinese fabs have sharply increased utilization. Rising AI-server demand is now reshaping China’s memory sector.

Leading the transition is CXMT, which began phasing out DDR4 earlier this year and plans to shift more than 60% of production to DDR5 by year-end, with the remainder moving to LPDDR4/LPDDR5. Chinese analysts view this restructuring, combined with rising IC exports, as a deliberate effort to pull more of the global memory supply chain toward China.

Market prices already reflect the shift. DDR4 modules in Shenzhen’s Huaqiangbei market have surged to the rough equivalent of 288 dollars, prompting phrases like “memory more expensive than gold.” The industry views this as a transitional distortion from DDR5 migration but also warns that once CXMT fully enters DDR5, renewed price competition and margin pressure will be unavoidable.

China is also moving into HBM. CXMT has supplied 16nm-based HBM3 samples to Huawei and partners, targeting 2026 for large-scale mass production. The company plans to apply yield-improvement capabilities developed during DDR5 ramp-up directly to HBM3. If CXMT stabilizes output and yield, its parallel push into DDR5 and HBM could alter market pricing and equilibrium. Chinese reports claim DDR5 yields above 80%, approaching levels of leading global firms.

A strategic move to reset the market structure

Samsung’s DRAM price increases are widely interpreted not as short-term profit taking but as a strategic move to reshape the market. With AI data-center demand creating a supplier-dominant environment, Samsung appears intent on structurally lifting price levels and reinvesting the cash flow into next-generation processes. In markets with large technological gaps, leaders can maintain higher price floors without significantly harming demand, while followers must defend volume at lower margins. Over time, this widens the profitability gap.

Samsung restarted construction of its Pyeongtaek Line 5, delayed during five years of memory downturn, after AI demand surged. The company plans domestic investment of 308.22 billion dollars over five years, including 41.10 billion dollars for Line 5, targeting full operation in 2028. Pyeongtaek, spanning two complexes, is already a major hub for memory and logic; the new line further entrenches its role as a core base for next-generation memory and foundry.

Line 5 will host HBM4/HBM4E, 2nm, and 1.4nm processes. Samsung aims to pre-secure capacity for surging HBM4E demand after 2027 and optimize process combinations for major clients such as Nvidia. Running HBM, DDR-class DRAM, and advanced foundry processes within one complex maximizes yield-management flexibility and accelerates product-mix adjustments.

Rival SK hynix is also committing 410.96 billion dollars to the Yongin cluster, focusing on HBM4, HBM4E, and 321-layer NAND, signaling that high-value memory investments are entering an overheated phase. Market leaders appear determined to maintain elevated price levels to secure investment capacity and widen the technology gap. What appears as a short-term price shock is increasingly viewed as the opening stage of a long-term strategy to reshape technology, capacity, and competitive positioning across the memory industry.