Hedge Fund Expansion and Surging Leverage Turn “Safe” U.S. Treasuries Into a Risk Asset

Input

Modified

BIS chief warns of hedge fund leverage

Post-regulation shift to offshore accounts and non-bank funding

Market-function fragility raises risk of sharp spread movements

A warning has been issued calling for targeted regulation of hedge funds that generate massive profits through excessive leverage in the Treasury market. The alarm—focused on cash-futures arbitrage as a driver of market volatility—has gained traction as so-called “basis trades” surge. At the same time, concerns are rapidly growing that liquidity buffers in the Treasury market will weaken further as China continues to reduce its holdings of U.S. government debt.

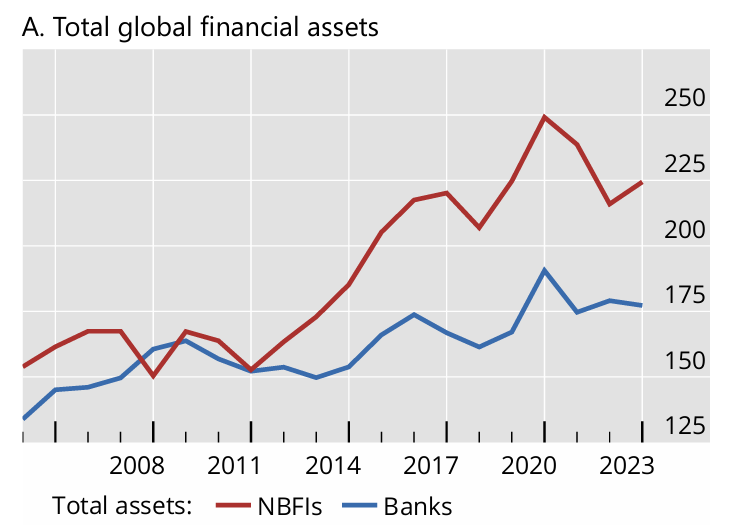

Regulatory evasion → expansion into non-bank sectors

According to Reuters on the 27th (local time), Pablo Hernández de Cos, head of the Bank for International Settlements (BIS), said at an event at the London School of Economics that “in an environment of rapidly rising public debt, the center of gravity in the Treasury market is shifting from banks to non-bank financial institutions (NBFIs).” He warned that “high-leverage transactions concentrated among hedge funds are increasing the fragility of Treasury market liquidity,” adding that “if this structure is exposed to shocks, market stability could come under immediate strain.” His assessment echoes a growing sense that short-term rate volatility is weakening the Treasury market’s shock-absorbing capacity.

The core issue is the so-called “basis trade”—a cash-futures arbitrage strategy. It exploits tiny differences between cash Treasuries and Treasury futures by buying the cash bond and shorting the corresponding futures contract to lock in the spread, typically only 1 or 2 basis points (0.01–0.02%). While the yield is small, most hedge funds borrow heavily against Treasuries and repeat the purchase cycle, expanding their positions up to as much as 100 times. The fact that a 5-bp move is considered a “home-run trade” in the market shows how even micro-spreads can translate into major profits.

De Cos noted that “about 70% of bilateral dollar repo transactions involving hedge funds, and about 50% of euro transactions, occur with zero haircut,” meaning collateral is accepted without any discount. This effectively allows near-unlimited leverage against Treasury collateral. Citing the 2021 margin-call shock in Treasury futures, he warned that “if the same pattern repeats, the market will face such shocks with even greater fragility.” He also projected that as aging demographics and rising defense spending push up fiscal pressures, advanced-economy debt-to-GDP ratios could reach 170% by 2050.

Two policy solutions were proposed. First, expanding the use of central clearing to enhance fairness and transparency among market participants. Second, imposing minimum haircut requirements on securities pledged by hedge funds to curb excessive borrowing at the source. Cutting off excessive leverage would prevent market shocks from being amplified through leveraged positions. De Cos stressed, “The fact that non-bank institutions are intermediating public debt at record levels represents a serious financial-stability risk,” underscoring the need for targeted regulation.

Falling borrowing costs + stable spreads

De Cos’s warning gains weight amid rapid growth in hedge fund basis trades that have exploited regulatory blind spots. According to SIFMA, U.S. Treasuries see about USD 750 billion in daily turnover. This suggests that if leveraged positions unwind suddenly, Treasury prices—as well as rates and the broader repo market—could face cascading disruptions. The BIS estimated in a quarterly report last year that leveraged short positions in the Treasury futures market totaled roughly USD 600 billion.

The surge in basis trades is attributed to shifts in the interest-rate environment and improved funding conditions. While long-term Treasury yields soared, repo borrowing costs remained relatively stable, widening the gap between Treasury coupon income and repo interest payments in favor of hedge funds. Combined with massive Treasury issuance by the U.S. Treasury Department and the Federal Reserve’s quantitative tightening—which flooded the market with long-term bonds—hedge funds effectively became “buyers of last resort.”

Stricter regulations on banks also pushed leveraged trades toward hedge funds. The Supplementary Leverage Ratio (SLR), introduced after the global financial crisis, restricted balance-sheet expansion for banks and dealers, reducing their capacity to absorb Treasuries. Non-bank institutions, operating largely outside these regulatory constraints, filled the gap. As a result, bilateral repo transactions with virtually no haircut surged, and large portions of basis-trade leverage accumulated in offshore accounts, leaving regulators unable to monitor total exposure in real time.

Even within the Federal Reserve, concerns have emerged. Fed Governor Lisa Cook said in a Georgetown University speech on the 20th that basis-trade activity “improves Treasury-market efficiency and liquidity in normal times, but in stress periods, crowded positions can unwind simultaneously and amplify instability.” According to Fed reports, Cayman Islands-based hedge funds absorbed more U.S. Treasuries between January 2022 and December 2023 than all other foreign private investors combined. As of Q1 this year, hedge funds held 10.3% of cash Treasuries, surpassing the pre-pandemic peak of 9.4%.

A system-risk ignition point

Meanwhile, China’s continued reduction of its U.S. Treasury holdings is cited as an additional factor heightening the risk of instability in hedge fund leveraged positions. As of June last year, China held USD 780.2 billion in Treasuries—down 26.5% from 2021—and markets expect China could sell another USD 300 billion over the next 3–4 years. This implies private investors and leveraged funds will need to absorb even more of the massive issuance from the U.S. Treasury.

Weakening demand for U.S. Treasuries is already evident in the cash market. At a recent USD 58 billion auction for 3-year Treasuries, investor demand was weak enough that dealers were forced to take 20.7% of the supply—the highest share since December 2023—suggesting institutions are increasingly reluctant to buy even short-dated securities. With demand weakening even for safe-haven assets and leveraged positions expanding, even minor price movements could trigger one-sided waves of buying or selling.

Experts warn that in such an environment, leverage tied to basis trades may become a critical point of vulnerability. As one of the pillars supporting demand for the world’s primary safe asset gradually weakens, the swelling concentration of funds in basis trades makes market balance increasingly delicate. Ultimately, de Cos’s warning that “in an era of record public debt, exposing the Treasury market to leveraged players means even tiny rate shocks could spill over into other asset markets” is understood in this context.