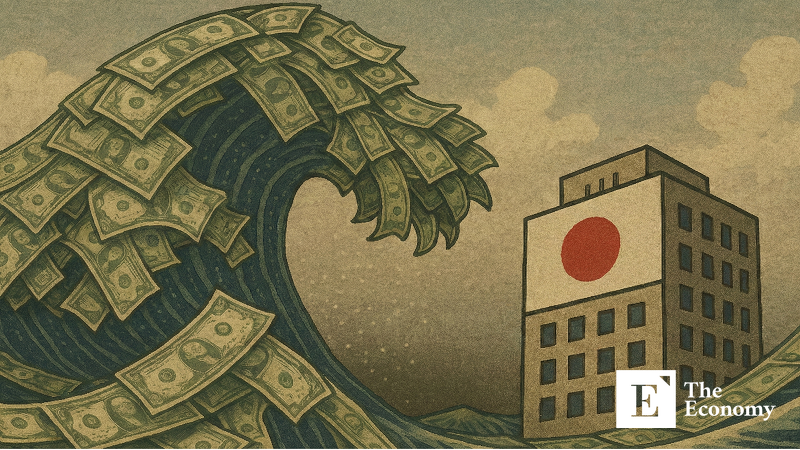

Speculative Domestic Demand and Influx of Chinese Capital Sustain Overheating in Tokyo’s Property Market

Input

Modified

Distorted bubble driven by short-term trading by Japanese residents and inflows of Chinese capital Urban living conditions deteriorate as concerns grow over the “Sinicization” of regional tourist areas Asset exodus fueled by China’s economic instability accelerates migration to Japan

A warning by renowned Japanese architect Riken Yamamoto that Tokyo is “degenerating into a colony for the wealthy” is increasingly materializing. Japanese residents have gravitated toward short-term property trading aimed at capital gains, while Chinese capital has poured in massive liquidity to preserve assets, creating a layered structure of speculative demand that is distorting the market. As a result, conflicts with local residents are intensifying across both urban centers and regional areas over the erosion of living environments, while asset flight driven by China’s economic instability is reshaping Japan’s demographic landscape.

“Tokyo as a Colony of the Wealthy”: Market Distortions Deepen amid Domestic Speculation and Chinese Capital Inflows

According to Bloomberg on the 21st (local time), Yamamoto—winner of the 2024 Pritzker Prize, often dubbed the Nobel Prize of architecture—delivered a sharply critical assessment of Tokyo during a recent lecture at the Foreign Correspondents’ Club of Japan, likening the city to a colony built for the wealthy, or more precisely, for neoliberal elites. He argued that Tokyo’s once human-scale urban fabric, where small shops and affordable housing coexisted, has lost its essence amid unchecked ultra-luxury development. Data from real estate analytics firm Tokyo Kantei show that, as of 2024, one quarter of the 812 tower condominium buildings in the greater Tokyo area were constructed within the past decade, while an additional 19.4 million square feet of large-scale office space is scheduled to come online by 2026. Yamamoto warned that this trajectory undermines urban diversity and produces exclusionary spaces inaccessible to ordinary citizens.

His concerns are borne out by market data. Tokyo’s forest of high-rise buildings is increasingly functioning as investment assets rather than genuine living spaces. The average price of newly built condominiums across Tokyo’s 23 wards reached approximately $1.06 million in October last year, up 18.3% year on year, yet vacancy rates in central districts such as Chiyoda and Minato exceed 10%, underscoring a stark disconnect between prices and end-user demand. This bubble has been jointly engineered by domestic and foreign speculative forces operating through different mechanisms. Japanese residents, for their part, have focused on short-term arbitrage exploiting market volatility. Ministry of Land, Infrastructure, Transport and Tourism data show that 8.5% of newly built condominiums in Tokyo during the first half of 2024—rising to 12.2% in six central wards—were resold within a year, with 98% of these transactions conducted by Japan-based residents. Treating apartments as short-term financial instruments akin to equities, these investors have driven up turnover and asking prices. Land Minister Yasushi Kaneko has signaled tighter regulations, stating that speculative transactions are undesirable regardless of nationality, while developers have moved to restrict pre-handover resales.

Chinese capital, by contrast, has played a different role by absorbing inventory with deep cash reserves and propping up price floors. Amid a historic depreciation of the yen, Japanese real estate has come to be viewed as a safe haven, prompting Chinese buyers to purchase multiple luxury apartments—often priced around $3.4 million each—in cash for long-term holding or asset shielding rather than short-term trading. The Financial Times reports that some buyers have even relied on underground financial networks, including so-called “mirror transfer” schemes in which renminbi are laundered through African trade channels before being converted into yen in Japan. The convergence of domestic short-term speculation and Chinese cash-driven accumulation has inflated the bubble further, threatening to hollow out urban centers as retail districts and medical facilities lose viable demand.

Chinese Capital Inflows Disrupt Market Order, Fueling Friction and Resentment among Japanese Residents

These macro-level distortions are increasingly intruding into the daily lives of residents, stoking social conflict. A prominent example is Harumi Flag, a 5,600-unit mega-complex redeveloped from the Tokyo Olympic Village. In a market long shaped by the belief that homes depreciate the moment they are purchased, the complex became a symbol of changing perceptions as resale prices surged well above initial offering levels. Behind this appreciation, however, lies significant Chinese capital participation. Local reports estimate that 15% to 20% of the units were acquired by buyers of Chinese nationality, with prices subsequently nearly doubling, deepening a sense of relative deprivation among genuine end-users.

Tensions have also escalated over the deterioration of living conditions. Residents have lodged complaints about illegal taxi operations and unauthorized short-term lodging activities that undermine residential tranquility. In February last year, public anger peaked after a three-year-old child was struck by a vehicle suspected of operating as an illegal taxi. Friction has also emerged in the rental market, as well-capitalized foreign landlords clash with Japanese tenants. Media reports have highlighted cases in which Chinese investors, after acquiring buildings, demanded tenants triple their rents or vacate the premises. In one rental complex in Tokyo’s Itabashi Ward, residents reported repeated violations of housing rights after ownership was transferred to a Chinese corporation, including the installation of key boxes for illegal short-term rentals without consent and the suspension of elevator services. Tenants have voiced fears that no Japanese residents will remain in the area.

The spillover of capital inflows has extended beyond Tokyo into regional tourist destinations, broadening the scope of conflict. In Isawa Onsen in Yamanashi Prefecture, roughly 30% of accommodation facilities have been absorbed by Chinese capital, effectively transforming the area into a Chinese-oriented tourist enclave. The head of the local ryokan cooperative expressed mixed feelings, remarking that while becoming a Chinatown was not ideal, it was preferable to a town going dark and deserted. Data from Nikkei show that, as of 2023, 55% of foreign buyers of land or buildings near key security sites in Japan were Chinese nationals, and the number of Chinese residents in Japan is projected to surpass one million next year. This trend signals changes extending beyond economics into social order, security, and cultural identity, prompting growing calls for regulatory responses.

China’s Asset Exodus and the “Run” Craze Turn Weak-Yen Japan into a Safe Haven

The frictions emerging in the property market foreshadow a broader demographic shift driven by not only capital flows but also human migration. Japan is witnessing a sharp rise in arrivals from mainland China, fueled by the so-called “run” phenomenon—a colloquial term derived from the English word “run,” denoting the impulse to escape China in search of a better life. Once confined largely to the wealthy, this migration trend has expanded to include IT engineers, researchers, and other middle-class professionals. In response, the Japanese government tightened business visa requirements in October last year, raising the minimum capital threshold to approximately $222,000 and strengthening employment criteria, yet migration demand has shown little sign of abating.

As family-based migration increases, education and living environments have become critical conduits for capital inflows. Tokyo’s Bunkyo Ward, home to a concentration of elite public elementary schools, has gained a reputation among Chinese parents as an “education mecca.” The ward’s Chinese population grew by roughly 50% between 2019 and 2024, and Chinese social media platforms have even popularized the term “3S1K” to refer to four prestigious local schools, spurring school-district-driven relocation. Japan’s appeal over traditional immigration destinations such as the United States or Canada stems from geographic proximity, cultural familiarity rooted in shared Chinese characters, and, above all, economic advantages amplified by the weak yen. High-rise apartments in Toyosu, a sought-after waterfront area in Koto Ward overlooking Tokyo Bay, are priced at around $8,300 per square foot, a level viewed as competitive relative to prime districts in Seoul or Beijing.

At the core of this migration wave lies an asset exodus triggered by the collapse of China’s property market and mounting political uncertainty. High-net-worth individuals in China are reducing exposure to domestic real estate, beset by declining returns and liquidity stress, and reallocating portfolios toward gold and Japanese property. The acceleration of wealth redistribution policies under the banner of “common prosperity” has further intensified efforts to diversify assets offshore. Institutional differences also play a decisive role: unlike China, where the state retains land ownership and grants individuals usage rights capped at 70 years, Japan guarantees perpetual ownership of both land and buildings. This distinction holds strong appeal for investors seeking durable asset transfers. A Chinese investor operating hotels in Japan noted that permanent land ownership, unavailable in China, combined with attractive pricing, makes Japan particularly suitable for long-term investment.

Japan’s institutional stability has also emerged as a powerful magnet for capital. The property market allows foreign buyers loan-to-value ratios of up to 50%, with mortgage rates hovering in the low 1% range, keeping entry barriers low. The absence of punitive taxation on multiple homeownership and limited policy volatility further enhance predictability. While China lacks inheritance taxes, facilitating wealth accumulation, Chinese investors appear increasingly willing to accept Japan’s higher tax burden in exchange for asset security. As a result, foreign investment in Japanese real estate reached a record high of approximately $7.9 billion in the first half of last year. A real estate analyst observed that Japan’s reliance on market mechanisms rather than heavy-handed policy intervention makes it a uniquely predictable and stable destination for long-term investment.