Surge in Seoul Apartment Listings Following Lee’s Holding Tax Pressure, Prospect of Additional Supply Expansion

Input

Modified

Listings surge beyond Gangnam to Nowon and Dobong Capital gains tax surcharge deferral extended from three to four months Homebuyers without property allowed to purchase tenant-occupied units

As President Lee continues to tighten pressure on multi-homeowners, apartment listings have increased not only in Seoul’s Han River belt but also in outlying districts. The rise in listings in peripheral areas, where buying momentum had recently accelerated, signals that sellers now outnumber buyers. With the government introducing measures allowing multi-homeowners to dispose of tenant-occupied properties, additional supply is expected to enter the market.

Seoul Listings Up 7.5% in Two Weeks

According to real estate platform Asil on the 11th, the number of apartment listings in Seoul stood at 60,417 as of the 10th. This marks a 7.5% increase in just over two weeks from January 23, when President Lee began posting messages on X targeting multi-homeowners and listings totaled 56,219. Listings rose in 21 of Seoul’s 25 districts, with only Gangbuk, Seongbuk, Geumcheon, and Guro posting declines.

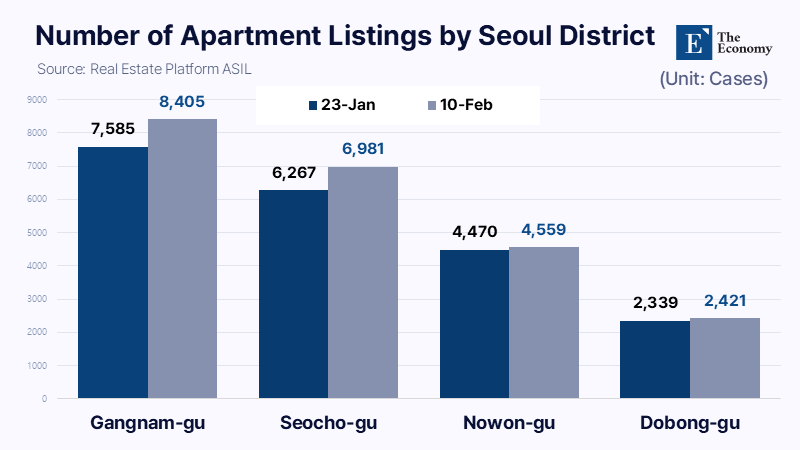

By district, listings surged particularly across the Han River belt, including Gangnam. In Seongdong District, listings rose 22.2% from 1,212 to 1,481 over the same period. Gangnam District saw listings increase 10.8% from 7,585 to 8,405, while Seocho District recorded an 11.4% rise from 6,267 to 6,981.

In Gangnam, some properties have been listed at discounted prices to mitigate anticipated holding tax burdens. A 113-square-meter unit at Raemian Blestige in Gaepo-dong, Gangnam, was recently listed at approximately $3,225,000, down from a transaction price of roughly $3,300,000 for the same size in December. In other major complexes across Gangnam, listings have appeared at reductions of $225,000 to $300,000. Notably, even single-homeowners in the district are placing properties on the market, reportedly to preempt potential future increases in holding taxes.

Inventory is also building in Seoul’s outer districts. In Nowon District, listings reached 4,559, up 2% from 4,470 on January 23. Dobong District recorded a 3.5% increase over the same period, while Dongdaemun saw listings climb 11% from 1,515 to 1,682. As supply emerges in key areas such as the three Gangnam districts—Gangnam, Seocho, and Songpa—and the Han River belt, listings in outer districts are rising in tandem, partly driven by households seeking to trade up.

Eased Residency Requirements for Tenant-Occupied Transactions and Mortgage Rules

With the government pressing multi-homeowners to sell while opening policy pathways to facilitate tenant-occupied transactions, listings are expected to rise further. The government announced that homebuyers without property who purchase multi-homeowner properties located in designated land transaction permit zones with existing tenants will be granted up to a two-year deferral of the mandatory owner-occupancy requirement. Although the government has signaled the resumption of capital gains tax surcharges to induce sales, market participants had argued that mandatory occupancy rules in permit zones were impeding transactions. The measure also safeguards existing tenants’ residency for the duration of their original lease contracts.

Deputy Prime Minister and Minister of Economy and Finance Koo Yun-cheol stated that the policy reflects “difficulties faced by citizens who own multiple homes leased out and cannot immediately move in,” adding that the owner-occupancy requirement will be deferred during the lease term but enforced upon its expiration. To ensure transactions are centered on end-users, only buyers without property qualify. The deferral period is calculated based on the date of the enforcement decree amendment announcement, not the expiration of the capital gains tax surcharge deferral.

Currently, homebuyers using mortgage loans must move into the purchased property within six months. With the occupancy requirement now deferred, this condition has been relaxed accordingly. Buyers can therefore obtain mortgages even when acquiring tenant-occupied homes owned by multi-homeowners. Given varying rent-to-value ratios across properties, authorities are considering limiting the deferral within defined parameters. Market observers expect a cap ensuring that the combined total of the rental deposit and mortgage loan does not exceed a 40% loan-to-value ratio. For older complexes with relatively low deposits, buyers could bridge the gap with mortgage financing to complete transactions.

The government has also differentiated deadlines for contracts and final payments eligible for exemption from capital gains tax surcharges. In areas already designated for adjustment prior to the October 15 measures—including the three Gangnam districts and Yongsan—contracts must be signed by May 9 and closing completed within four months, by September 9, to qualify. The government had initially considered a three-month window but extended it by one month to reflect transaction realities. In the remaining 21 Seoul districts newly designated under the October 15 measures, as well as 12 districts in Gyeonggi Province, a six-month grace period applies, with final payments required by November 9.

Separately, the government is reviewing reductions in tax incentives for registered rental housing operators. At a Cabinet meeting at the presidential office, President Lee sharply criticized the current framework that allows apartment rental operators to permanently benefit from capital gains tax exemptions even after fulfilling mandatory rental periods. “There are individuals who own 300 or 500 units, yet still qualify for surcharge exemptions even if they sell 20 years later. That is problematic,” Lee said, adding that while a limited window for disposal will be granted, properties should ultimately be taxed on par with general housing to ensure fairness. Deputy Prime Minister Koo responded that authorities will set a deadline requiring sales within a specified period after rental termination to retain tax benefits.

Lee “No Market Prevails Over the Government”

Across administrations, real estate policy has long shaped political fortunes. With each change in government, regulatory tightening and easing have oscillated, producing pronounced market volatility. The swings were most evident under the Roh Moo-hyun and Moon Jae-in administrations. Roh pledged an all-out campaign against speculation, introducing more than 30 rounds of measures, including the comprehensive real estate holding tax.

Yet amid entrenched supply-demand imbalances, regulations failed to temper price expectations. Capital shifted into adjacent areas, repeatedly triggering spillover effects. Over five years, Seoul apartment prices surged nearly 60%, giving rise to the term “runaway housing prices.” Moon likewise vowed not to lose the war against speculation and rolled out more than 20 policy packages, but market participants ultimately internalized the distortions associated with heavy-handed intervention.

Now in his second year in office, President Lee has reignited a direct confrontation with the housing market. The tone contrasts sharply with remarks two months ago acknowledging the absence of effective measures despite mounting criticism over rising prices in Seoul and the metropolitan area. Through social media, Lee asserted that while no government can fully defeat the market, neither can the market defeat the government. He added that if the nation overcame insurrection, it could certainly contain real estate speculation, and that normalizing the housing market would be far easier than lifting the stock market to 5,000 points. In announcing the end of capital gains tax surcharge deferrals for multi-homeowners, he even referred to “real estate demons” and “speculators devoid of conscience.”

Lee’s policy direction is clear: to correct a longstanding practice that reduces tax burdens solely on the basis of long-term multi-homeownership. Repeated extensions of deferrals have, in his view, undermined policy credibility. Restoring consistency through the reduction of tax exemptions stands at the core of the approach. Critics caution, however, that deploying higher holding taxes or ending capital gains tax deferrals as instruments of pressure may yield only short-term effects and risk generating deeper market distortions over time. Past tax-centric policies fueled demand for premium single properties, widened regional disparities, and shifted increased tax burdens onto tenants through higher deposits—side effects that cannot be overlooked.