Quiet Measures, Big Gains: How naval grey-zone tactics are reshaping naval power in the Northwestern Pacific

Input

Modified

China’s naval grey-zone tactics are reshaping maritime power without open war Industrial scale and constant presence give Beijing quiet leverage Without policy reform, strategic erosion will continue

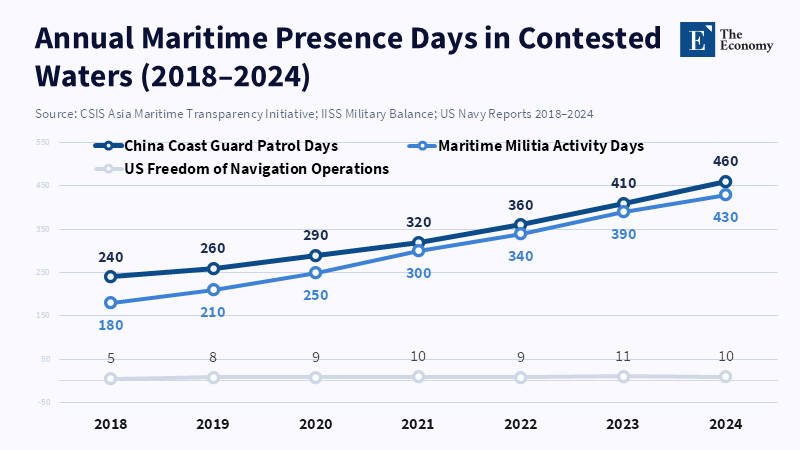

In 2024, it became clear that China's coast guard had become the largest in the world, with over 150 large patrol ships. However, this doesn't necessarily mean war is imminent. It points to something more subtle: a show of size, dedication, and how well they can manage things. Think of naval grey-zone tactics as actions taken in that area between peace and war. They depend on being present at all times, maintaining different levels of sea forces, and applying tactical pressure incrementally. These actions usually don't prompt a military response, but over time, they change who's in charge, normalize new behaviors, and reveal the strength of alliances. It's not about one big fight, but about adding up small advantages over time. When one country consistently has more ships, spends more time on patrol, and has a stronger industrial base, things quietly start to change. Naval grey-zone tactics aren't about winning quickly, but about gaining influence little by little. And that influence is building up in the Northwestern Pacific.

Naval Grey-Zone Tactics: Case Lineup

The use of naval grey-zone tactics in the South China Sea follows a pattern. Coast guard ships keep an eye on survey ships. Maritime militia ships gather in waters that are being argued over. Fishing boats work together in groups close to areas that are disputed. These aren't accidental moves; they're carefully planned to stay below the level that would cause armed conflict. They cause tension, wear out smaller navies, and test how fast they can react. Reports from people who watch security in the area show that for years, there have been more and more coordinated sea patrols and activity by paramilitary groups in these disputed zones. The goal is to gradually make this the new norm, in which each patrol adds to the record of presence and each event alters expectations about who controls access.

A similar thing is happening in the East China Sea and the Northwestern Pacific. Here, naval grey-zone tactics test where coalitions might fall apart. Patrols approach disputed islands. Airplanes get radar warnings. Research ships go near sensitive waters. These are like practice runs that gather info on how fast people respond, how well they communicate, and what their legal position is. They show which actions lead to protests and which go by without any reaction. This kind of testing creates a map of the strategic landscape. It measures the strength of the deterrent without firing any shots. Naval grey-zone tactics depend on this constant situational mapping. Over time, the information gathered becomes a playbook, meaning that gathering information quietly today reduces uncertainty if there's a crisis later.

The power of these situations derives from doing them repeatedly. One event will be forgotten quickly, but hundreds of events can alter the overall situation. Naval grey-zone tactics exploit this difference in how people perceive, turning persistence into an advantage in policy. The smaller countries in the area must decide every day whether to respond, and that daily decision is easier for the country with more ships and greater staying power. Being present turns into power.

How China Uses Naval Grey-Zone Tactics to Test US Naval Strength

Naval grey-zone tactics test the United States in measurable ways. First, they require the US to undertake more, including escort missions, surveillance flights, and joint patrols, which require fuel, maintenance, and crews ready to deploy. Second, they show where problems arise in working together, since coast guards, navies, and civilian groups follow different legal rules, and grey-zone pressure makes those differences clear. Third, they impose a strain on industrial capacity because being present at all times requires ships, which require shipyards, which require time.

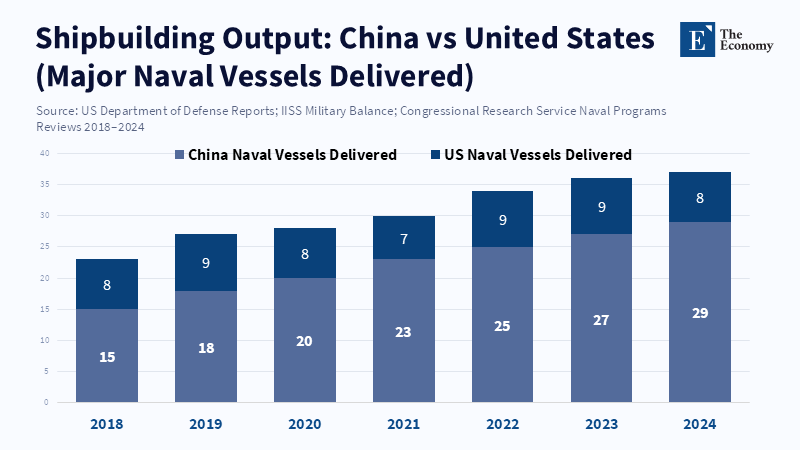

Recent defense reports indicate that China continues to build ships faster than the United States. While U.S. shipbuilding remains technologically advanced, it hasn't been building as many ships as China for several years. Even seemingly beneficial ideas, such as working with allies to build more ships, have limits because there are insufficient workers, supply chains are strained, and regulations impose delays that impede rapid expansion. Naval grey-zone tactics exploit this difference: pressure is applied quickly, whereas fixing industrial problems takes a long time.

The Korean MASGA proposal shows this tension. The plan is to work together to strengthen U.S. shipbuilding by leveraging allies' resources. That makes sense strategically, since industrial partnerships may enhance security. However, expanding shipyards and sharing technology won't produce ships immediately. Even if things go well, it would take years to increase production, whereas naval grey-zone tactics operate on a faster timeline, conducting daily tests and not waiting for industrial changes to occur. This difference in timing is important because if grey-zone pressure continues unabated, it shapes how people perceive who's in charge long before ship production can catch up.

The main point isn't that war is imminent, but that naval grey-zone tactics convert small advantages in operations into long-term influence. Industrial strength makes this even more effective because each extra ship means more days on patrol, and each day on patrol makes the situation seem more normal. Over time, just being there hardens into an expectation.

What This Means for Institutions and Policy

Naval grey-zone tactics are just as much about administration as they are about military action. They require navies, coast guards, legal authorities, and diplomatic routes to work harmoniously. Education and training need to reflect this, with war colleges and policy schools treating grey-zone competition as a core subject rather than an add-on. Leaders need to understand maritime law, supply chains, and communication tactics because grey-zone events occur within bureaucratic systems. Prepared institutions respond calmly, while unprepared ones either make things worse or freeze up.

The procurement policy also needs to change. High-end combat ships are still important, but having forces there to show presence is just as important in grey-zone competition. Cheaper patrol ships, platforms that can be changed for different uses, and reserve crews can make it possible to be present more often without using up combat fleets. Naval grey-zone tactics work best when opponents struggle to keep up with endurance, and increasing patrol capacity reduces that problem, signaling commitment without making matters worse.

Managing alliances is another important area. Naval grey-zone tactics target uncertainty. If different partners respond differently, the pressure increases. Having coordination systems in place, shared logistics centers, and legal responses agreed on in advance reduces that risk. Being clear in diplomacy can weaken gradual encroachment. Industrial cooperation, like shipbuilding partnerships, should move forward, but expectations need to be realistic, since structural expansion takes time and interim measures need to fill the gap.

Some people contend that focusing on grey-zone competition could lead to overreacting, warning against treating every event as a military situation. That's a valid concern, but the answer lies in persistent measurement. Naval grey-zone tactics succeed when they're ignored, but they also succeed when they're overplayed. The appropriate response lies between steady presence, clear legal policies, and disciplined restraint.

Another argument is that comparing industrial strength ignores the differences in quality, since US naval platforms usually have improved capabilities. That's true, but grey-zone competition values quantity and visibility, where patrol days and surveillance coverage matter. The actor who maintains a visible presence shapes the story of who's in control. Naval grey-zone tactics rely on this: quality deters high-end conflict, and quantity shapes everyday dominance.

The Numbers of Presence

Naval grey-zone tactics aren't dramatic; they're repetitive, testing, probing, and normalizing. In 2024, the growth of China's coast guard fleet symbolized this approach: more ships mean more patrol hours, more patrol hours mean greater routine control, industrial scale drives operational persistence, and operational persistence feeds strategic leverage. The lesson is simple: Maritime power in the Northwestern Pacific is being transformed through accumulation, not confrontation, and policy responses must keep pace with that transformation. Industrial reform, alliance coordination, and educational adaptation must occur simultaneously. Naval grey-zone tactics reward patience and punish complacency. If current trends continue, the balance will not shift through battle but through habit, with the side that shows up every day, in greater numbers and with institutional coordination, defining the region's future maritime order.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of The Economy or its affiliates.

References

Al Jazeera (2025) Japan gov’t greenlights record $58bn defence budget amid regional tension, 26 December.

AP (2026) Prime Minister Takaichi's party wins a supermajority in Japan's lower house, 2026.

Asian Military Review (2026) Government poll shows public support for defense exports as Tokyo considers easing key restrictions, February.

Defense News (2025) Japan passes record defense budget while still playing catch-up, 16 January.

Japan Ministry of Defense (2025) Defense of Japan 2025, Tokyo: Ministry of Defense.

Ministry of Defense Japan (2023) Implementation Guidelines for the Three Principles on Transfer of Defense Equipment and Technology, Tokyo: Government of Japan.

Nippon.com (2026) Cabinet Office survey shows record high support for strengthening Japan’s Self-Defense Forces, 28 January.

Naval News (2025) Japan approves record defense budget for fiscal year 2026, 30 December.

Reuters (2026) Why Japan’s emboldened PM won’t toy with risks of a weak yen, February.

SIPRI (2024) Trends in International Arms Transfers, 2023, Stockholm: Stockholm International Peace Research Institute.

The Guardian (2026) Sanae Takaichi’s conservatives cement power in landslide Japan election win, February.

Xinhua / News agencies (2025) Japan’s defense budget tops record 9 trln yen for fiscal 2026, 26 December.

People’s Daily (2026) Commentary on Japan’s expansion of military exports, 12 February.