ECB Says “Not About U.S. Tariffs”—What Lies Behind China’s Shifting Export Map

Input

Modified

Diagnosis of “Limited Tariff Impact” Faces Questions

China’s Low-Price Offensive vs. Expanding European Regulation

$1 Trillion Trade Surplus Raises Risk of Backlash

Following the imposition of steep U.S. tariffs, China’s export landscape has been shifting rapidly. While the European Central Bank (ECB) assessed that the increase in Chinese exports to Europe cannot be conclusively attributed to higher U.S. tariffs, actual trade data show a simultaneous contraction in the U.S. share and expansion toward Southeast Asia, Europe, and Latin America. This shift, which delivered China a record trade surplus, is increasingly showing signs of triggering tighter regulations and escalating trade frictions across multiple jurisdictions. Markets are closely watching the implications that China’s recalibrated export strategy could have on the global trading order.

“Part of a Broader Global Trade Realignment”

According to The Wall Street Journal (WSJ), ECB economists said in a report released earlier this month that “the rise in Chinese exports to the euro area is closer to the result of a longer-term structural shift that predates President Donald Trump’s tariff increases.” The analysis suggested that Chinese firms have for years been cultivating new markets and rerouting trade flows, meaning that supply chain realignment and market diversification had already progressed to a certain degree. The ECB added that this development should be viewed not as a simple “volume shift,” but as part of a broader restructuring of global trade patterns.

The assessment has drawn attention as it aligns with China’s recent trade data. According to figures from China’s General Administration of Customs, the country’s total imports and exports last year reached 45.47 trillion yuan, equivalent to approximately $6.37 trillion at an exchange rate of $0.14 per yuan, marking a 3.8% increase from the prior year. Exports rose 6.1% to 26.99 trillion yuan, or about $3.78 trillion, while imports edged up 0.5% to 18.48 trillion yuan, or roughly $2.59 trillion. As recently as the first half of last year, prevailing expectations were that U.S.-led tariff pressure would sharply curb exports, yet overall trade volumes instead continued to expand.

By region, reduced reliance on the United States coincided with growth in third markets. Chinese exports to the United States declined 19.5% last year. Although tariffs on Chinese imports, once as high as 145%, were reduced to 47.5%, they remain above the 35% margin threshold that many Chinese exporters view as the break-even line. Meanwhile, exports to Africa surged 26%, shipments to Southeast Asia climbed 13%, exports to the European Union rose 8%, and Latin America recorded a 7% increase. China traded with 240 countries, with trade volumes expanding with 190 of them. The ECB’s reference to a “long-term shift” appears to reflect this reconfiguration of trade geography.

The product mix has also evolved. Exports of so-called “new three” products—electric vehicles, lithium batteries, and solar panels—rose 27.1% year-on-year, while automobile exports surpassed 7 million units. High-tech and high value-added exports totaled 5.25 trillion yuan, or about $735 billion, up 13.2% from the previous year. These figures suggest that China has broadened its global footprint by leveraging strategic sectors beyond the U.S. market. At the same time, the ECB’s conclusion remains the starting point for debate over how these flows are reshaping industrial dynamics within the eurozone.

Rising Concerns Over Europe’s Industrial Base

European governments have moved to reinforce trade barriers as they monitor what they see as a wave of low-priced Chinese exports. French President Emmanuel Macron recently stated that “Europe’s industrial and innovation model must be protected,” adding that higher tariffs on China could follow if trade fails to rebalance. His remarks fueled speculation that the EU’s existing tariffs—reaching as high as 45.3% on Chinese electric vehicles—could be increased further.

Automotive data illustrate the context for these tensions. According to the China Passenger Car Association (CPCA), China exported 576,000 vehicles in January, a record high, with hybrid models driving expansion in Europe. EU tariffs apply to battery electric vehicles produced in China but not to hybrids, a regulatory distinction that has supported market penetration. Companies such as BYD are also pursuing local production within Europe, potentially expanding their market share. CPCA stated that China’s growing share in the new energy vehicle market provides a solid foundation for continued export growth.

The steel sector has also seen defensive measures intensify. In October last year, the EU replaced its previous steel safeguards with a new tariff-rate quota (TRQ) regime, cutting annual import quotas to 18.3 million tons, a 47% reduction from prior levels. Imports exceeding quotas face tariffs of 50%, up from 25%. The EU also introduced a “melt and pour” rule requiring documentation of the country of origin for crude steel, aimed at preventing Chinese steel from entering through third countries under altered origins.

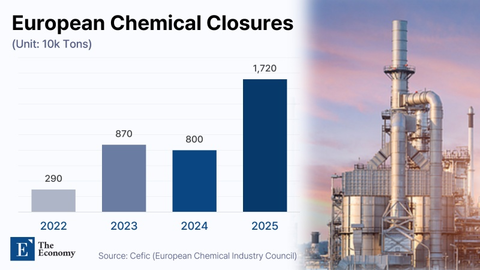

These regulatory responses reflect broader concerns about Europe’s industrial erosion. The EU’s share of global steel production has fallen from 9% in 2014 to around 7% in recent years, and more than 100,000 steel jobs have been lost over the past 15 years. Since 2022, companies have faced rising research and development costs linked to green transition and carbon neutrality goals, even as cheaper imports have gained ground. Pressure on strategic sectors such as automobiles and steel is increasingly viewed not merely as a trade dispute, but as a question of industrial survival.

Low-Price Strategy and Market Distortion

Critics have described China’s export approach as “deflation export,” arguing that excess output generated by weak domestic demand and overcapacity is being offloaded abroad at discounted prices, distorting pricing structures and profitability in importing countries. In recent years, China expanded production capacity aggressively, but the property downturn and subdued private investment limited domestic absorption of that output. Surplus supply subsequently flowed into global markets, intensifying downward price pressure.

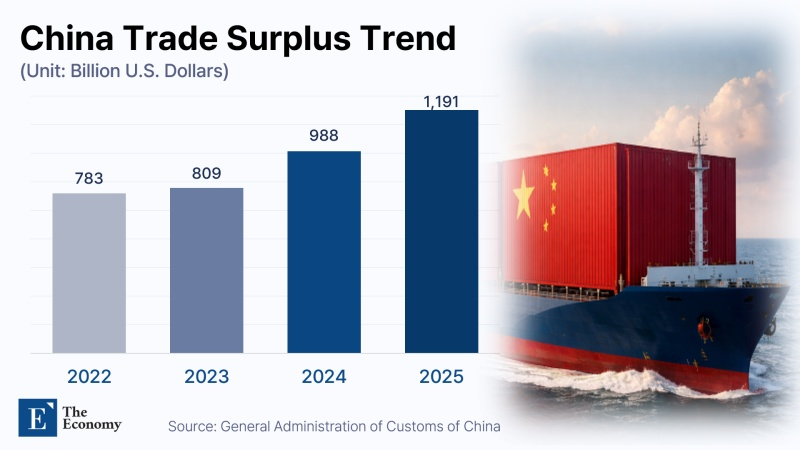

This dynamic feeds into trade imbalance concerns highlighted by Macron. China’s trade surplus reached $1.189 trillion last year, up 20% from the prior year and a new record. Merchandise exports totaled $3.77 trillion, rising 5.5% in dollar terms and 6.1% in yuan terms. With export growth far outpacing import gains, the surplus widened sharply. Some analysts attribute part of this expansion to currency effects, including the relative weakness of the yuan, while others frame it as a growth model that captures global demand at the expense of other producers.

Trade tensions have continued to escalate. Late last year, China imposed anti-dumping duties ranging from 4.9% to 19.8% on EU pork and related products for five years, widely interpreted as retaliation for EU tariffs on Chinese electric vehicles. As China is the world’s largest pork consumer and a major market for EU exporters, restricted access could weigh on European prices. Surplus supply could then spill into other Asian markets, amplifying competitive pressure regionally.

Frictions with France have also intensified. After France’s High Council for Strategic Planning recommended a 30% tariff on Chinese goods, China’s state-run Global Times suggested Beijing should consider anti-dumping and anti-subsidy investigations into French wine and impose reciprocal tariffs on EU products. EU wine exports to China totaled about $700 million last year, accounting for more than 30% of China’s wine imports, roughly half of which were French. Should reciprocal tariffs materialize, agricultural and food sectors on both sides would face direct impacts.

In this context, the debate over China’s deflationary exports extends beyond individual industries to encompass broader trade policy clashes. While China points to its record surplus as evidence of competitive strength, importing economies warn of mounting strain on domestic industries and employment. If Europe’s protective measures intensify, China’s export expansion strategy may encounter increasing constraints. Whether the record surplus proves to be a short-term peak or a catalyst for successive waves of trade barriers will depend on policy responses abroad and the pace at which China rebalances toward domestic demand.

Comment